What Happens in Gold Trading after a Inverted Hammer Candles Pattern?

Inverted Hammer candles pattern is a bullish reversal candlestick pattern. It forms at the bottom of a Gold trend.

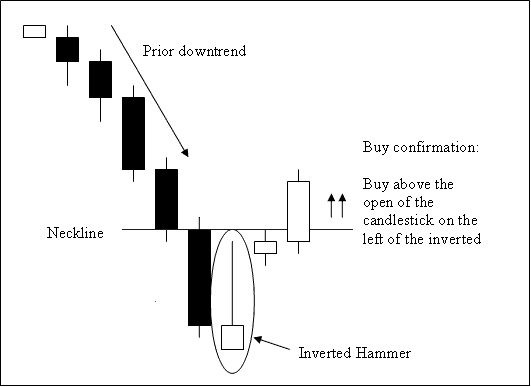

Inverted Hammer xauusd candlesticks pattern forms at the bottom of a down gold trend & indicates the possibility of reversal of the downwards xauusd trend.

What Happens in Gold Trading after a Inverted Hammer Candlesticks Pattern?

Technical Analysis of Inverted Hammer Candlestick Pattern

A bullish reversal buy trading signal is confirmed when a candlestick closes above the neck-line, this is the opening of candlestick on the left side of this inverted hammer candles pattern. The neck line point in this case forms the resistance level.

Stop orders for the buy xauusd trades should be placed a few pips below the lowest xauusd trading price on the recent low once a trader opens a trade based on this candlesticks pattern setup. An inverted hammer candles pattern is named so because it signifies that the xauusd market is hammering out a bottoms.