Reversal Gold Candlesticks Chart Patterns

Hammer Bullish XAUUSD Candles Patterns

Reversal xauusd candles patterns occur after an extended prior trend. Therefore, for a xauusd candles pattern to qualify as a reversal candles pattern there must be a prior trend.

These reversal candlesticks patterns are:

- Hammer Candles Pattern & Hanging Man Candles Pattern

- Inverted Hammer Candles Pattern & Shooting Star Candles Pattern

- Piercing Line XAUUSD Candles Pattern & Dark Cloud Cover Candles Pattern

- Morning Star Gold Candles and Evening Star Gold Candles

- Engulfing Candles Patterns

Hammer Candles Pattern and Hanging Man Candles Pattern Gold Candles

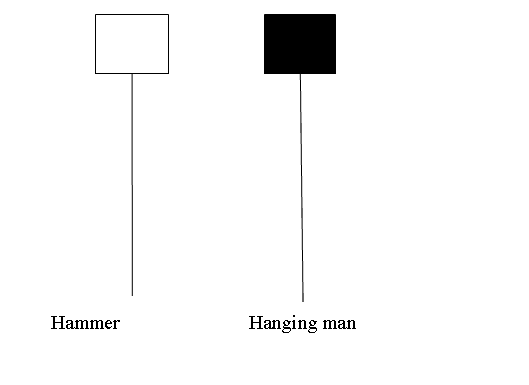

Hammer Candles Pattern and Hanging Man Candles Pattern xauusd trading candlesticks look alike but hammer is bullish reversal candles pattern and hanging man is a bearish reversal candlesticks pattern.

Hammer Candles Pattern and Hanging Man Candles Pattern Gold Candles

Hammer Candlesticks Patterns

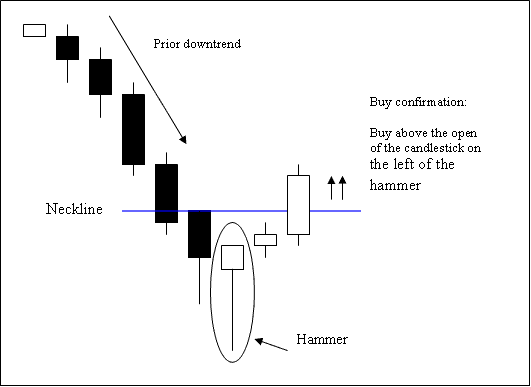

Hammer is a potentially bullish pattern that forms during a gold downward trend. It is named so because the xauusd market is hammering out a market bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

Hammer Gold Candles

Gold Trading Analysis of Hammer Candles Patterns

The buy signal is confirmed when a gold candlesticks closes above the opening xauusd price of the gold candlesticks on the left side of the hammer candlesticks pattern.

Stop orders should be place a few pips just below the low of the hammer candle.

Inverted Hammer Bullish XAUUSD Candlesticks Patterns

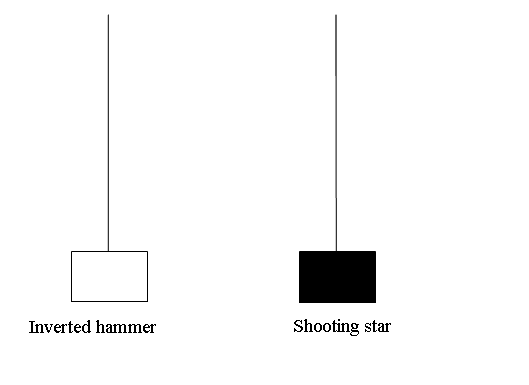

Inverted Hammer Candles Pattern and Shooting Star Candles Pattern gold candlesticks look alike. These have a long upper shadow and a short body at the bottom. Their color does not matter. What matters is the point where they appear whether at the top of a xauusd market trend (star) or the bottom of a xauusd market trend (hammer).

The difference is that inverted hammer is a bullish reversal candles pattern while shooting star is a bearish reversal candlesticks pattern.

Upward Gold Trend Reversal - Shooting Star Gold Candles

Downward Gold Trend Reversal - Inverted Hammer Gold Candles

Inverted Hammer Candles Pattern and Shooting Star Candles Pattern Gold Candlesticks Chart Patterns

Inverted Hammer XAUUSD Candlestick

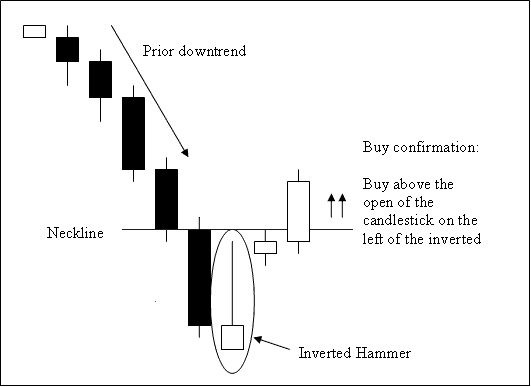

This is a bullish reversal candles pattern. It forms at the bottom of a Gold trend.

Inverted hammer occurs at the bottom of a downward gold trend & indicates the possibility of reversal of the downwards xauusd trend.

Inverted Hammer Gold Candle

Gold Trading Analysis of Inverted Hammer Gold Candlestick

A buy is confirmed when a gold candlesticks closes above the neckline, this is the opening of the gold candlesticks on the left side of this pattern. The neckline point in this case forms the resistance level.

Stop orders for the buy xauusd trades should be placed a few pips below the lowest xauusd price on the recent low.

An inverted hammer is named so because it signifies that the xauusd market is hammering out a bottoms.