Stochastic Oscillator Strategy

This topic should be called: Combining Together Stochastic with other Indicators, but Stochastic Gold System sounds real nice.

Stochastic can work with other signals to build a complete strategy. For our examples, we will use it with these things:

- RSI

- MACD

- Moving Averages Gold Indicator

Example 1: Stochastic Oscillator Trading System

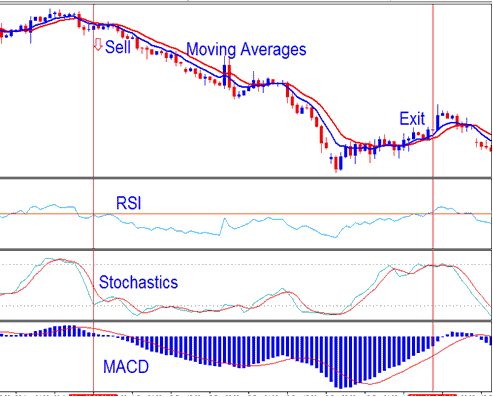

Sell Signal Generated using Stochastic Trading System

From our system the sell xauusd trade signal is generated when:

- Both Moving Averages are heading down

- RSI is below 50

- Stochastic heading and moving downwards

- MACD heading downward below centerline

A sell signal for gold trading configurations was issued once all specified rules were satisfied. The corresponding exit signal will be determined and generated upon the appearance of a signal indicating movement in the contrary trend direction, specifically when the technical indicators reverse their output.

The advantage of utilizing such a system lies in the incorporation of various indicators to confirm trade signals, thereby minimizing the occurrence of whipsaw trading in gold transactions.

- Stochastic - is a momentum oscillator xauusd technical indicator

- RSI- is a momentum oscillator xauusd technical indicator

- Moving Averages Gold Indicator- is a market trend following technical indicator

- MACD- is a market trend following indicator

Combining multiple technical indicators is really beneficial and helpful because a combination of signals is far superior to depending on just one. The technical indicator combinations for the xauusd support one another and filter out erroneous whipsaw trading signals.

A trend indicator gives gold traders the big picture. Pair it with momentum tools for stronger entry and exit signals in gold trades.

The synergy between various indicators and the trading signals they produce aids in interpreting a substantial amount of market dynamics.

Example 2: Stochastic Oscillator Trading System

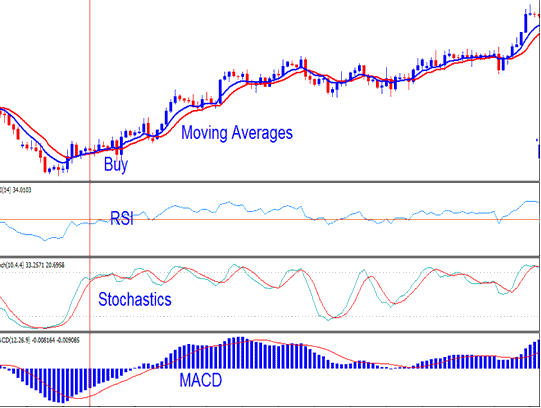

Buy Trade Signal Triggered Utilizing a Trading System Based on the Stochastic Oscillator

In this scenario, the overall trend is clearly upward, though the stochastic oscillator may produce some false signals or whipsaws during gold trading. The challenge is to determine how a trader can avoid these misleading trading situations.

The resolution lies in examining supplementary technical studies, such as the MACD indicator. A gold trader could have sidestepped the whip-saw, even though the MACD technical study was on the verge of generating a zero-line crossover signal. Concurrently, the steepness or gradient at which the moving average technical indicators reversed was insufficiently sharp to indicate a definitive shift in market direction. The difficulty is that identifying market fake-outs is not immediately apparent: it's a proficiency that demands time for development, but eventually, one gains the ability to spot whip-saws effortlessly.

A useful rule of thumb is that as long as the MACD indicator remains above the zero centerline, the market trend is still upward, even if the MACD lines are trending lower temporarily. As illustrated in the foregoing example, the MACD technical indicator never dropped below the zero mark, after which the upward trajectory resumed with the MACD indicator maintaining its position above the zero line and continuing its ascent.

In sideways markets, the Stochastic gives quick signals. But these often lead to false moves. Pair it with other indicators. Confirm signals with one or two more tools.

Get More Courses & Tutorials at:

- Reversal Chart Patterns Double Tops and Double Bottoms XAUUSD Patterns

- Open Charts List Panel Window of Open Charts in MT4 Platform Software

- How to Save a MetaTrader 4 Chart Template in MT4 Platform Software

- How to Generate XAU USD Buy & Sell Trade Signals Using Gold Strategy

- How Do I Read a New XAUUSD Order on Gold MT4 iPhone Trade App?