Trading Leverage and Margin Trading Explanation & Examples

Margin required : It's the amount of money your broker requires from you as a trader to open a trade transaction. It's denoted in %s.

Equity : It is the total amount of capital you have in your trading account.

Used margin : sum of money in your trading account which has already been used up when buying a gold trading contract, this contract is the one that is shown in open trade positions. As a trader you cannot use this sum of money after opening a trade transaction because you've already used it and it's not available to you.

In other words, because your broker has opened up a trade transaction for you using the capital you have borrowed, you must preserve this usable margin for your trading account as a collateral to allow you to continue using this leverage he has given you.

Free margin : amount in your account which you can use to open new positions. This is the amount of money in your trading account which hasn't yet been leveraged because you've not yet opened a trade position with this money - this amount is also very important for you as a because it enables you as a trader to continue to hold your open trade transactions as will be described below.

However, if you over use xauusd trading leverage, this free trading margin will go below a certain % at which your broker will have to close out all your positions automatically, leaving you with a large loss. broker at this point will automatically close-out all your open trade transactions because if your open transactions are left open then your broker would lose money that you'd have borrowed from them.

This is why as a trader should always make sure that you have a lot of free margin. ToIn-order-to do this as a trader never trade more than 5 percentage of your account, in fact 2 percent is adviced.

Difference Between Gold Leverage Set by the Broker and Used Trading Leverage

If the set trading leverage option is 100:1, what it means is thatthat-as-a-trader you can borrow upto $100 for every 1 dollar you have in your trading account, but you don't have to borrow all the $100 for every 1 dollar you have, you can select that you want to borrow 50:1 or 20:1. In this instance though leverage option is set at 100:1 your used trading leverage will be the 50:1 or 20:1 that you have borrowed to make a trade transaction.

Example:

You have $1000 (Equity)

Set 100:1

Leverage Used = Amount used /Equity

If you buy gold lots equal to $100,000 you'll have used

= 100,000/1000

= 100:1

If you buy xauusd trading lots equal to 50,000 dollars that as a trader you will have used

= 50,000/1000

= 50:1

If you buy xauusd trading lots equal to 20,000 dollars that as a trader you will have used

= 20,000/1000

= 20:1

In these 3 cases you can see that allthough the set is 100:1

The used is 100:1, 50:1, 20:1 depending on the size of gold lots traded.

So Why not Just Choose 10:1 option as the Maximum Gold Trading Leverage? Because to keep within proper risk management rules it's even recommended that traders use less than this?

This question might seem straight forward but it's not, because when you trade you use borrowed money known A.K.A. Leverage. When you borrow capital from anyone or from a bank you must sustain a security or collateral to get a loan, even if the security is based on monthly deduction from your salary, the same thing with Gold Trading.

In gold trading the security is known as margin. This is the capital that you deposit with your broker.

This is calculated in realtime as you trade. To keep your borrowed money you must sustain what is known-asreferred-to-as the required trading capital (your deposit).

Now if Your Gold Trading Leverage is 100:1

When trading, if you have $1,000 and use leverage option 100:1 and buy 1 standard lot for $100,000 then your margin on this trade position is the $1000 dollars in your account, this is the money that you'll lose if your open trade transaction moves against you, the other $99,000 that's borrowed, they will stop out the open gold positions automatically once your $1,000 has been taken by the xauusd market.

But this is if your broker has set 0% Gold Margin Requirement before stopping out your xauusd trades automatically.

For 20 percent requisite before stopping out your xauusd positions automatically, then your trades will be closed out once your account balance gets to $200

For 50 % requisite of this level before stopping out your xauusd positions automatically, then your trades will be closed out once your account balance drops to $500

If they set 100% requisite of this level before stopping out your open positions automatically, then your trade position will be stopped out once your trading account balance gets to $1,000: Explanation the trade transaction will close-out as soon as you execute it because even if you pay 1 pip spread your trading account balance will drop to $990 and the needed percent is 100 percent i.e. 1,000 dollars, therefore your trade orders will immediately get closed out.

Most brokers do not set 100 percent prerequisite, but there are those that set 100% are not suitable for you at all, select those set 50 percent or 20 percent margin requirements, in fact, those xauusd brokers which set their margin prerequisite at 20% are some of the best because the likelyhood they close out-out your trade transaction is reduced as displayed in the example above.

To know about this level that is calculated by your platform automatically - MetaTrader 4 Trading Platform will show this as "Gold Margin Requirement", This will be displayed as a percent the higher the percentage the less likely your positions are to get closed out.

For Example if

Using 100:1

If leverage is 100:1 & you trade gold lots equivalent to $10,000

$10,000 dollars divide by 100:1, your used trading capital is $100

Calculation:

= Capital Used * Percentage(100)

= $1,000/$100 * Percentage(100)

Gold Margin Requirement = 1,000 %

InvestorTrader has 980 percent above required amount

Using 10:1

If leverage is 10:1 & you trade gold lots equivalent to $10,000

$10,000 dollars divide by 10:1, your used capital is $1000

Calculation:

= Capital Used * Percentage(100)

= $1,000/$1000 * Percentage(100)

Gold Trading Margin Requirement = 100 %

Investor has 80% above requirement amount

Because when one has a higher leverage means that they have more percentage above what's required (Also Known As More "Free Gold Trading Margin") their open gold trading transactions are less likely to get stopped out. This is the main reason why traders will select the option 100:1 for their account but according to their risk management guidelines, they will not trade above 5:1 leverage ratio.

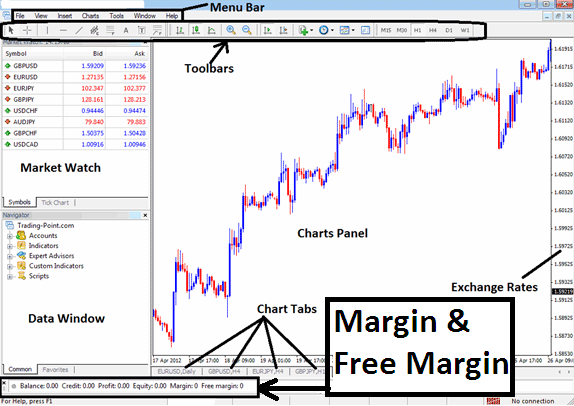

These Levels are Shown on the Platform Screenshot Below as an Example:

MetaTrader 4 Gold Software