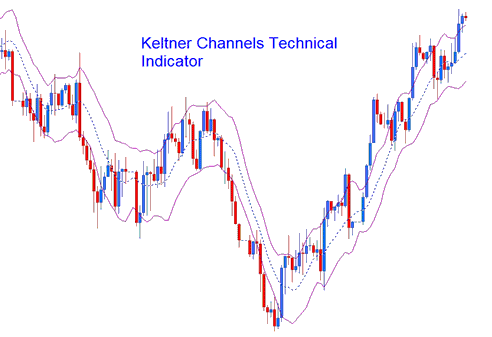

Keltner Bands Gold Trading Analysis & Keltner Bands Trading Signals

Created by Chester Keltner. Described in his book "How to Make Money in Commodities"

Keltner Bands are based on ATR technical indicator, the bands use ATR values to draw the bands lines.

These Bands form Channels that help to spot the Gold market trends using this simple volatility channel.

Keltner Bands

Construction

Keltner Channels are similar to Bollinger Bands except for the fact that Bollinger Bands use standard deviation technique to determine market volatility & to draw the bands.

For the keltner bands instead of using the standard deviation the average true range (ATR) measure of volatility is used.

This gold indicator is an n number of periods exponential moving average of the closing trading price. These bands are created by

Adding (for the upper line) and

Subtracting (for the lower line)

An (n period simple moving average of an n period ATR) * an ATR multiplier.

XAUUSD Trading Analysis & Generating Trading Signals

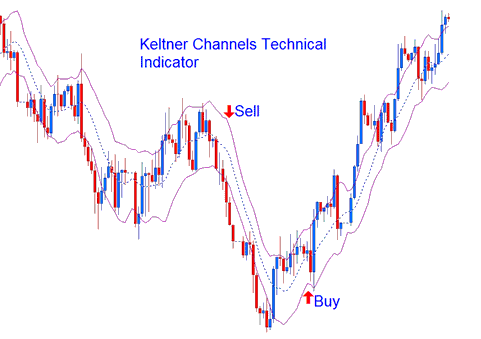

This gold indicator can be traded in much the same way as the Bollinger Bands

Continuation Trading Signals

When trading price moves outside the bands then a continuation of the current gold trend is implied. A buy signal is when the channels are moving upwards and sell signal is when the channels are moving downwards

Continuation Buy Sell Trading Signals

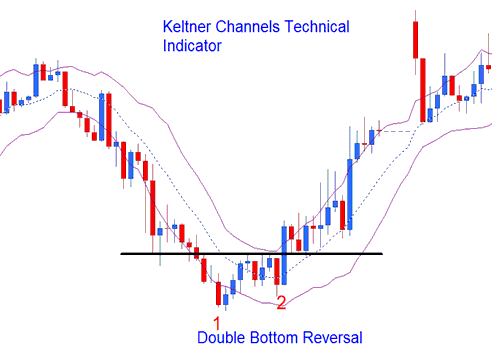

Reversal Gold Signals - Double Tops and Double Bottoms

Tops and Bottoms made outside the bands followed by tops and bottoms made inside the Keltner channels indicate signal for reversals in the market trend.

Reversal Trading Signals

Ranging Gold Trading Markets

In range markets a move which originates from one Keltner channel tends to go all the way to the other channel.