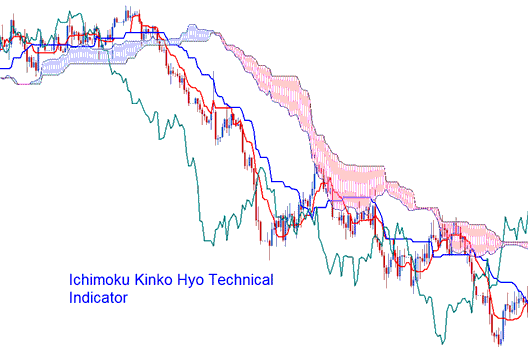

Ichimoku Indicator

Ichimoku is a Japanese charting technique that was developed before by a Japanese newspaper writerjournalisteditor, with the pen name known of as Ichimoku Sanjin.

- Ichimoku meaning: 'a glance' or 'one look'

- Kinko means 'equilibrium' or 'balance'

- Hyo is a Japanese term for "chart"

Thus, Ichimoku means, 'a glance at an equilibrium chart'. Ichimoku attempts to identify the likely direction of price & help the gold trader to determine the most appropriate time to enter or exit the market.

Calculation

This indicator has five lines that are drawn using the middle points of highs and lows from the past. The five lines are figured out like this:

1) Tenkan-Sen (Conversion Line): Represented by the Red Line, calculated as (Highest High + Lowest Low) / 2 over the preceding nine price bars.

2) Kijun-Sen: The Base Line: Blue Line (Highest High + Lowest Low) / 2, for last 26 price periods

3) Chikou Span (Lagging Span): Shown in Green. Calculation: Today's closing price projected 26 price bar periods back in time.

4) Senkou Span A: Calculated as the mean of the Tenkan Sen and Kijun Sen, projected forward by 26 trading periods.

5) Senkou Span B: Leading Span-B: (Highest High + Lowest Low)--/--2[Highest High + Lowest Low]--/--2, which is derived from the previous 52 pricing periods and plotted 26 price bars ahead.

Kumo: Cloud: area between Senkou Span A and B

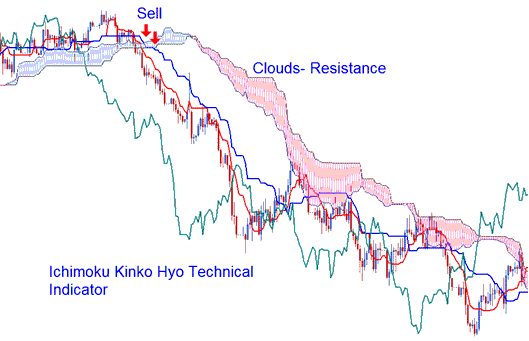

Gold Analysis and Generating Signals

Bullish trading signal - Tenkan-Sen crosses Kijun-Sen from below.

Bearish trading signal - Tenkan-Sen crosses the Kijun-Sen from above.

However, there are different levels of strength for the buy & sell trading signals generated.

Analysis in XAUUSD Trading

Bullish cross-over signal forms above the Kumo (clouds),

Strong buy signal.

Bearish cross-over signal occurs below the Kumo (clouds),

Strong sell signal.

If a bullish/ bearish crossover signal takes place within the Kumo (clouds) it's considered a medium strength buy or sell signal.

A bullish cross-over that occurs below the clouds is considered a weak buy signal while a bearish crossover that occurs above the clouds is regarded a weak sell signal.

Support & Resistance Zones

We can guess where support and resistance are based on the presence of Kumo (clouds). Kumo can also show us the market's current overall direction.

- If the price is above the Kumo, ruling market trend is said to be upward.

- If the price is below Kumo, ruling market trend is said to be downwards.

The Chikou Span, also referred to as the Lagging Span, serves to gauge the strength of a buy or sell indication.

- If the Chikou Span indicator is below the closing price of the last 26 periods ago & a sell short sell signal is generated, then the power of the trend is downward, otherwise the trading signal is regarded to be a weak sell signal.

- If there's a bullish signal & the Chikou Span is above the price of the last 26 periods ago, then the power of the trend is to the up side, otherwise it's considered to be a weak buy signal.

Get More Lessons:

- Where to Know When to Buy a XAU USD Trending Upwards

- How Do You Pick the Best XAU USD System to Trade XAUUSD?

- How Do You Trade Head and Shoulders Chart Pattern?

- Bollinger Bands and Fibonacci Ratios: XAU/USD Indicator Analysis

- Step-by-Step Guide on Drawing Downward Trend lines Utilizing MT4 Software

- How to Put Relative Strength Index, RSI Tool on Gold Graph

- Buying Gold vs Selling Gold in Gold Charts Using XAU/USD

- XAU/USD – How to Approach Technical Trade Analysis

- How do you trade a falling wedge pattern?

- Showing Where Fibonacci Levels Are on Charts When Prices Are Going Up or Down