How Do I Analyze Reversal Chart Patterns?

How Do I Read Reversal Chart Patterns?

Reversal Chart Patterns are used to confirm the reversal of the gold trend direction - once this reversal chart pattern setup is confirmed.

How to Interpret Reversal Chart Patterns

Reversal xauusd chart patterns are formed after an extended gold trend move either upwards or downwards - these reversal chart patterns signal that the trend direction is about to reverse.

How to Trade Reversal Chart Patterns

- Double Tops Reversal Pattern

- Double Bottoms Reversal Pattern

- Head and Shoulders Reversal Chart Pattern

- Reverse Head and Shoulders Reversal Chart Pattern

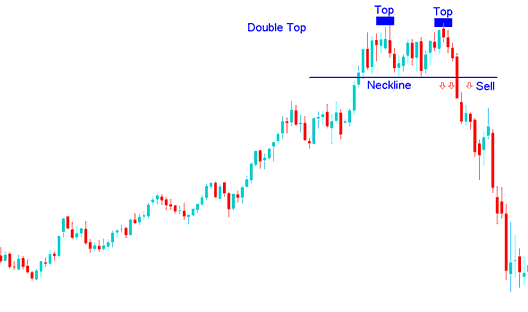

Double Tops Trading Pattern Technical Analysis

Double tops xauusd pattern is a reversal chart pattern that is formed after an extended gold upward trend move. Double tops xauusd chart pattern is made up of 2 consecutive xauusd price peaks that are roughly equal, with a moderate trough in between these two xauusd price peaks - double tops.

Trading Gold Interpret Double Tops Reversal Chart Pattern

Double tops xauusd chart pattern is considered to be complete once the xauusd price makes the second peak and then penetrates the lowest xauusd price point between the xauusd price highs (double tops), this lowest xauusd price point is called the neckline. A sell signal from this double tops chart pattern is generated when the price breaks and moves below the neckline.

In gold trading the double tops chart pattern is used as an early gold signal that a gold upward trend is about to reverse. However, double tops chart pattern is only confirmed once the neckline is broken & the xauusd price moves below the neckline. Neckline is just another name for the last xauusd price support level formed on the xauusd chart.

Analyze Reversal Chart Patterns

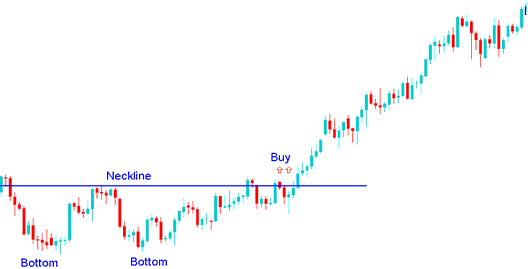

Double Bottoms Trading Pattern Technical Analysis

Double bottoms xauusd pattern is a reversal chart pattern that is formed after an extended gold downward trend move. Double bottoms xauusd chart pattern is made up of 2 consecutive xauusd price troughs that are roughly equal, with a moderate peak in between the xauusd price troughs (double bottoms).

Trading Gold Interpret Double Bottoms Reversal Chart Patterns

Double bottoms xauusd chart pattern is considered to be complete once the xauusd price makes the second xauusd price low and then penetrates the highest xauusd price point between the two xauusd price lows (double bottoms), the highest xauusd price point between the double bottoms is called the neckline. The buy signal from this double bottoms chart pattern is generated when the price breaks above the neckline and moves upwards above the neckline.

In gold trading the double bottoms chart pattern is an early gold signal that the downwards gold trend is about to reverse. Double bottoms xauusd chart pattern is only considered complete once the neckline is broken -price moves above the neckline. In this Double bottoms xauusd chart pattern the neckline is the xauusd price resistance level. Once this xauusd price resistance level is broken the xauusd price will move upwards.

Analyze Reversal Chart Patterns

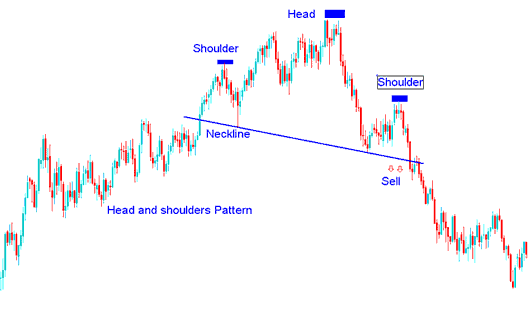

Head & Shoulders Trading Pattern Technical Analysis

Head and Shoulders pattern is a reversal chart pattern that is formed after an extended upward xauusd trend. Head and Shoulders chart pattern is made up of three consecutive xauusd price peaks, the left shoulder, the head and the right shoulder with 2 moderate xauusd price troughs between the shoulders.

Trading Gold Interpret Head and Shoulders Reversal Chart Patterns

Head and Shoulders chart pattern is considered to be complete once the xauusd price penetrates and moves below the neckline, the neckline is drawn by joining the two xauusd prices troughs between the shoulders.

Traders will place their sell stop pending orders just below the neckline - when price moves below the neckline a sell signal is generated by this head and shoulders chart pattern.

How Do I Read Reversal Chart Patterns

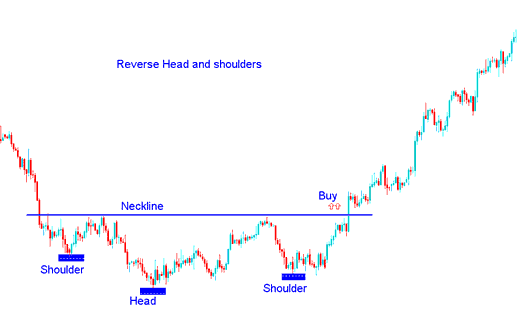

Reverse Head and Shoulders Trading Pattern Technical Analysis

Reverse Head & Shoulders pattern is a reversal chart pattern that is formed after an extended downward xauusd trend. Reverse Head and Shoulders chart pattern resembles an upside down head shoulders xauusd chart pattern.

Trading Gold Interpret Reverse Head and Shoulders Reversal Chart Patterns

Reverse Head & Shoulders chart pattern is considered to be complete once the xauusd price penetrates and moves above the neckline, the neckline is drawn by joining the two xauusd price peaks between the reverse shoulders.

Traders will place their buy stop pending orders just above the neckline - when price moves above the neckline a buy signal is generated by this reverse head and shoulders chart pattern.

How Do I Read Reversal Chart Patterns

Gold Trade and Interpret Reversal Patterns - Reversal Chart Patterns Gold Technical Analysis

Interpret Reversal Chart Patterns?