How Do You Draw Reversal Doji Candlestick Pattern?

This reversal doji candle pattern appears at market turning points and warns of a possible trend reversal in the Gold market trend. Below is an example of this reversal doji candlestick pattern

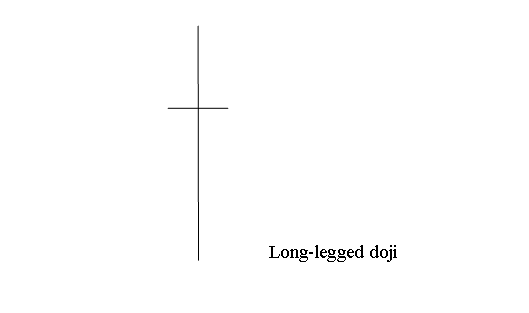

Doji is a candlestick pattern with same opening and closing xauusd price. There are various types of doji patterns which are formed on xauusd charts.

A doji candle is where xauusd price of gold for a specific trading time period closes almost at the same xauusd price. Doji candlesticks look like a cross, inverted cross or a + math sign.

This reversal doji candle pattern appears at market turning points and warns of a possible trend reversal in the Gold. Below is an example of this reversal doji candlestick pattern

Analyze Reversal Doji Candles Setup

Analysis of Doji Candlestick Pattern - All doji candles setup explain indecision in the Gold market this is because at the top of the buyers were in control, at the bottom the sellers were in control but none of them could gain control and at the close of the xauusd market the xauusd price closed unchanged at the same xauusd price as the opening xauusd price.

This doji candlestick pattern portrays that the overall xauusd price movement for that day was zero pips or just a minimum range of 1-3 pips. Reading these candle-sticks patterns need very small pip movement between the opening xauusd price & closing xauusd price.