Hammer Bullish XAUUSD Candlesticks Pattern

Hammer Bullish XAUUSD Candles Pattern

Reversal candles patterns occur after an extended prior trend. Therefore, for a candlesticks pattern to qualify as a reversal candlesticks pattern there must be a prior trend.

These reversal candles patterns are:

- Hammer Candlesticks Pattern and Hanging Man Candle Pattern

- Inverted Hammer Candles Pattern & Shooting Star Candle Pattern

- Piercing Line Gold Candle Pattern & Dark Cloud Cover Candle Pattern

- Morning Star Candles & Evening Star Candles

- Engulfing Candles Patterns

Hammer Candlesticks Pattern and Hanging Man Candlestick Pattern

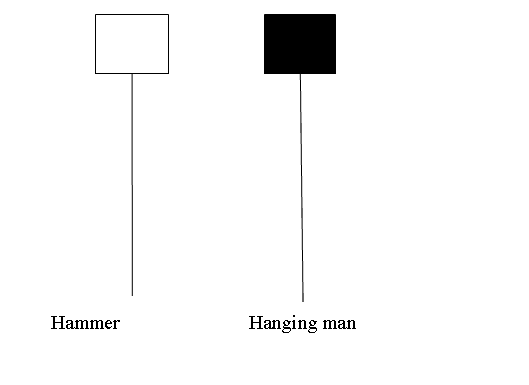

Hammer Candles Pattern and Hanging Man Candle Pattern candlesticks look alike but hammer candles pattern is bullish reversal candles pattern and hanging man is a bearish reversal candle pattern.

Hammer Candlesticks Pattern and Hanging Man Candle Pattern

Hammer Candlesticks Patterns

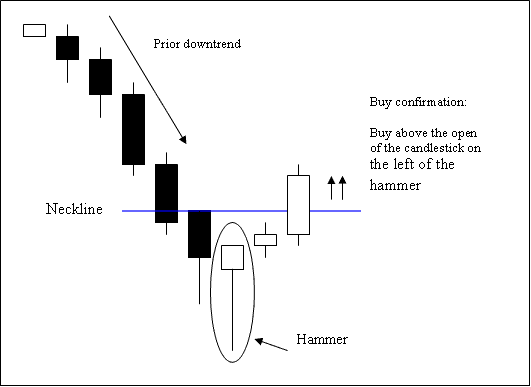

Hammer Candles Pattern is a potentially bullish candlestick pattern that forms during a downwards xauusd trend. It is named so because the xauusd market is hammering out a market bottoms.

A hammer candlestick pattern has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

Hammer Candles

Technical Analysis of Hammer Candles Pattern

The buy trading signal is confirmed when a candle closes above the opening xauusd price of the candlestick to the left side of this hammer candlestick pattern.

Stoploss orders should be set a few pips just below the low of the gold trading hammer candle pattern.