The 3 Major Gold Sessions: Asia, Europe and USA

Asian Session

During the Asian market only 8 % of total daily transactions go through Tokyo desks. This is the least active of the three major market sessions. Most of this 8% only involves yen based gold trading with very little transactions happening for other instruments. This is the reason why it is not suitable for one to trade during this period. Not trading this period will save you a lot of time & money.

European Session

The London/European market takes the lion's share of the total transactions, 34% of all transactions are carried out during this market session. London time zone is also well placed in terms of business hours for both eastern & western economies, this is when there are market overlaps and this results in high number of transactions during the this period. This time is most liquid & most volatile session for all the trading instruments.

The Europe time zone also includes the EUR zone member countries. EUR zone has 17 members & major banks of these countries are open & there is a lot of liquidity as many transactions are being executed.

US Session

The US market takes up 20% of all transactions. Most active time for trading is approximately from 8 am to 12 pm when both London and New York dealing desks are open. This is the time when there is generally the highest market volatility as it is also the time when majority of the major US financial data announcements are released.

European US Session Overlap

There are periods which have a greater volume of trade transactions, therefore increasing opportunities to make a profit.

For day traders the most productive hours are the London and the US session overlaps and this is the peak for xauusd trades is when these two overlap when there is a large volume of transactions and the xauusd market is most active.

During this over lap a substantial amount of economic news data is released generating a lot of price volatility and the xauusd prices move fast and there's a lot of opportunities to trade, this over lap offers the best market opportunity for those traders wanting to maximize profit.

The best hours for trading, are during this over-lap because the xauusd prices really move and the moves are decisive and offer the best chance to make profits

This is also why Asian traders, Japan will wait until afternoon to begin executing their orders, this is the period that will coincide with the Europe & USA sessions.

Asian investors will not open gold trading transactions during the Asian time, therefore as a trader from anywhere in the world it is best to stay away at this time, after all even the hedge funds and other pro investors from Asia will avoid this time & wait for until afternoon when it's a lot easier because of the liquidity during the US & UK overlaps.

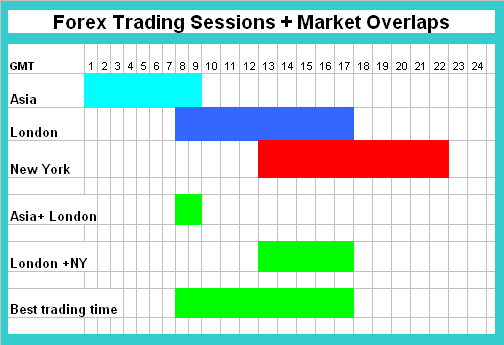

Therefore to come up with the best hours using based on these three markets sessions as shown below:

Market Hours & Overlaps

The chart above shows the timetable of when each session starts & when it ends. The chart also shows when there are overlaps and also shows the best hours based on these overlaps.

Summary:

Determine Your Schedule

The type of trader you are determines your schedule. If you don't have a lot of time then a longer term strategy would suit you best. If on the other hand you have a lot of time then you might decide to set a day trading schedule where you open gold trading transactions during the most active market hours. The above chart shows the best GMT times to be in the xauusd market - from around 800 GMT and 1800 GMT.

Determine your timeframe

To set up a schedule you need to determine your chart time frame. Try using different chart time frames until you find the most suitable and comfortable to use in accordance with your schedule.

Test your trading strategy

Test your trading strategy on a practice demo trading account for a period of time. Keep track of every transaction and monitor the progress of your schedule. Try to analyze what times are most profitable for your trading strategy.

Your strategy should be specified on the trading plan that you use.

To learn more about how to specify this in your plan, read the tutorial about Gold plan. This learn gold guide will show you an example of a format that you can use to specify your schedule.