Strategies for Risk Management

XAUUSD Money Management Policy & Risk Management Plan

The best way for a trader to get good at handling money in Gold Trading is to use Money Management Strategies Tools - Gold Risk Management Strategies PDF & make sure losses are smaller than the money they gain in Gold Trading. This is called the risk:reward ratio.

Different Strategies for Funds Management

This xauusd equity management strategy is one of the Money Management Strategies - XAUUSD Equity Management Strategies used to make a Trading strategy more profitable by only trading when you could earn 3 times more than what you risk - Money Management Strategies - Ways to Manage Equity.

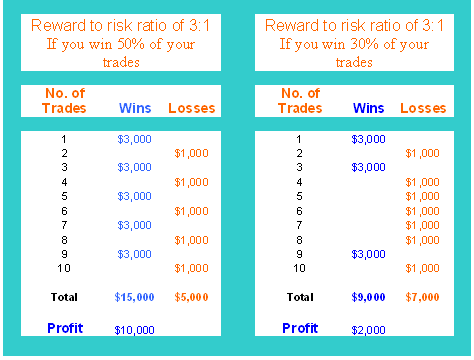

Trading with a high risk-to-reward ratio of 3:1 or higher significantly increases your long-term profitability potential when trading gold. The accompanying chart elaborates on effective money management strategies designed for XAUUSD trading success.

Gold: A Lesson on Money Management Trading Strategies within a Trader's Equity Management System

In the first example, it's clear that even if you achieve a win rate of only 50 percent in your trading positions, you could still realize a profit of $10,000. This illustrates different methods for equity management.

You would still be making money even if your system's win rate dropped to around 30%. Example of a Funds Management Strategy: Risk Management Tools and a Risk Management Plan.

Gold Risk Management Tools & Risk Management Plan - Just remember that whenever you've got a good risk reward ratio Risk Management Tools & Risk Management Plan, your chances of being profitable as a trader are greater even if you have a lower win percentage for your Trade system.

Never use a risk to reward where you can lose more pips on 1 trade position than you plan to make. It doesn't make sense to risk $1,000 so as to make only $100 dollars when trading the market.

Because you have to win 10 times to make the $1,000 back. If you lose ONLY once in your Trading then you as a trader have to give back all your Trading profits.

Employing a trading strategy lacking proper planning or logic can result in long-term losses. To enhance results, adopting a comprehensive gold trading strategy with proper money and risk management is crucial.

Different Strategies for XAU USD Equity Management

The percentage risk gold equity management strategy involves risking a consistent percentage of your equity balance for each trade position, serving as a tool for effective money management strategies within gold fund management tutorials.

Percent risk equity management technique specify that there'll be a certain % of your account equity balance that's at risk per each trade transaction. To calculate the % risk per each trade position, you need to know about 2 things, percentage risk that you have chosen in your equity management plan and lot size of an open order so as to calculate where to put the stoploss for your trade position. Since the % risk is known, a gold trader will use it to calculate the position size of the order to be placed in the market, this is known & referred to as position size.

Risk Management Tips and Money Rules for Traders

Maximum Number of Open Trade Positions

Another important thing to think about is how many trades you can have open at one time, especially when trading gold. This is an important factor in making rules for managing your money, which is part of funds management strategies.

For instance, if your trading plan dictates adhering to a 2 percent risk per trade, you might simultaneously operate a maximum of 5 open positions. Should all five of these positions close out incurring a loss on the same day, you, as an XAUUSD trader, would experience a total 10 percent reduction in your equity balance for that trading session.

Invest with Sufficient Gold Capital - Different Trading Methods for Risk Management

One significant mistake traders can make when trading gold is trying to start a trading account without having enough money to begin with.

A trader operating with restricted equity will often be anxious, consistently attempting to cut losses beyond reasonable XAUUSD trading limits. This often results in them being forcibly removed from their positions before achieving any measure of success with their chosen trading approach.

- Exercise Discipline When Gold Trading - Different Trading Methods for Risk Management

The most essential trait a trader can cultivate for profitability is discipline, which is defined as the capacity to outline a trading plan and adhere strictly to the defined money management rules within that plan.

A trading plan helps a gold trader stay disciplined. Discipline lets you give trades time to grow without exiting early due to risk fears. It also means you stick to your plan after losses. Build strong discipline in gold trading to make profits.

Managing Trading Account Equity Basics

Managing gold money is key to any trading plan, because it helps traders make profits when trading in the market. Managing equity is very important when trading with borrowed money. This market is known as one of the most active online financial trading markets, but it's also known as one of the most risky.

If you want to invest & trade successfully in the online market you should realize that it's very essential to have an effective money management trading strategy because you'll be using trading leverage to place your orders - Funds Management Strategies Tutorial.

The variation between average profits & losses should be strictly calculated, the trading profit on average should be higher than the losses on average when gold trading, otherwise won't yield any profits. In this case a trader has to formulate their account management rules & guidelines, the success of each trader depends on their character traits. Hence, every makes his own strategy and formulates their own money management guidelines based on the above money management method rules - Gold Tools of Money Management Strategies - Gold Risk Management Strategies Tutorial.

When you are placing your orders in the market also put your stop losses so that to avoid huge losses. Stop losses also can be used to lock in profits while trading the market.

Aim for a 3:1 profit-to-loss ratio. Favor gains in this risk-reward setup. Explore various methods for handling risks. Follow a clear risk plan.

If you think about these rules for handling your money, you can use them to help make your trading strategy more profitable. You can also try to create your own plan that might give you good profits when you use it with your Trade Money Management Plan.

Get More Lessons & Courses: