Engulfing Candlestick Rules

Engulfing Candlesticks Pattern

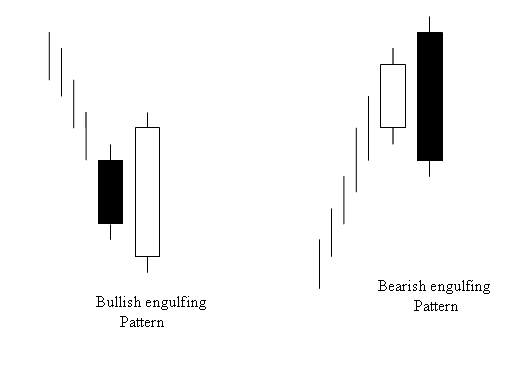

The Engulfing Candlestick pattern signals reversals. It can be bearish at the end of an uptrend or bullish at the end of a downtrend.

Examining the Bullish Engulfing and Bearish Engulfing Candlestick Patterns

Analysis of

The colour of the first candlestick shows trend of the day.

The second candlestick needs to completely cover the first one and have a color that goes against the current market direction.

For Bullish Engulfing colour of the candles should be Blue

For Bearish Engulfing colour of the candles should be Red

Engulfing Candle Strategy - A lesson on Bullish Candle Patterns - Examination of Engulfing Candlestick Indicator Patterns - The Bearish Engulfing Candlesticks Pattern within an Uptrend - The Bullish Engulfing Candlesticks Pattern within a Downtrend

Evening Star Candlesticks Pattern

Morning Star XAUUSD Candle

Morning Star Candlestick

XAU/USD Analysis of the Morning Star Candlestick Pattern

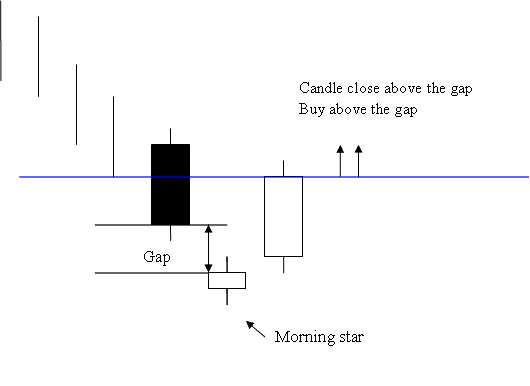

Morning star candle is a 3 day bullish reversal candlesticks pattern.

First day is a long black candlestick.

Second day is a morning star that gaps away from the long black candlestick.

Third day is a long white candles that fills the market gap.

The filling of the trading gap & closing of the white candles above the market gap is a strong bullish xauusd gold signal.

Traders and Investors should buy after the market price goes above the morning star candle pattern. This confirms a buy signal from this specific candlesticks pattern.

Evening Star XAU USD Candlestick

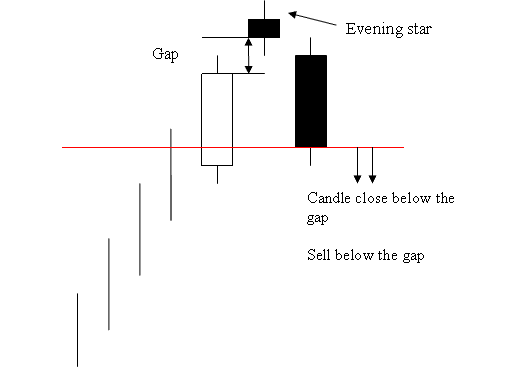

Opposite of morning star

Evening Star Candle

Trading Analysis of Evening Star Candlesticks Pattern

Evening star is a 3 day bearish reversal candlesticks pattern setup formation.

The first day is a long white candle.

Second day is the evening star that gaps away from the long white candlestick.

Third day is a long black candlesticks that fills the market gap.

The filling of the gap and closing of the black candlesticks below the gap is a strong bearish xauusd gold signal.

Sell your position when the market drops below the evening star candlestick gap. This move confirms the sell signal from the pattern.

Learn More Lessons & Topics:

- Key Gold Support and Resistance Levels

- How to Implement an XAUUSD Stop Loss Order

- Indicator Trading System Based on RSI for XAU/USD

- Introduction to Gold Trading: Getting Started

- Guide for Users of MetaTrader 4 Software

- XAUUSD Inverted Hammer – What This Gold Candle Tells You

- How do you fix MT4 sign-in problems with XAU/USD trading accounts?

- What Is an XAU/USD Practice Account? Key Insights Explained

- Categories of XAU/USD Orders