The Elliot Wave Theory in Gold Trading

Traders use this analysis to predict price moves. It spots peaks in crowd psychology. It notes XAUUSD highs and lows. It tracks group actions too. The model says human behavior creates patterns over time. Buy and sell choices show up in prices.

This analytical theory, the brainchild of Ralph Nelson Elliott, posits the fundamental belief that a vast number of processes and occurrences in the natural world manifest in recurring, five-wave market sequences. These recurring formations are directly adapted for trading analysis, serving to interpret and assess the behavior inherent in price trends through this specific technical analysis framework.

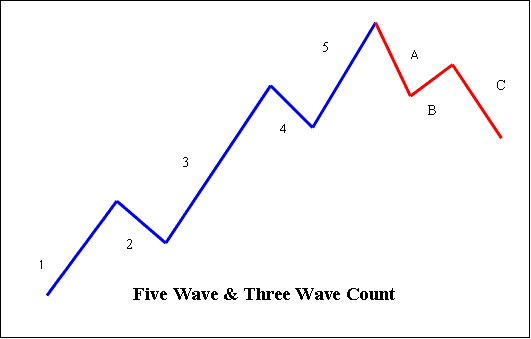

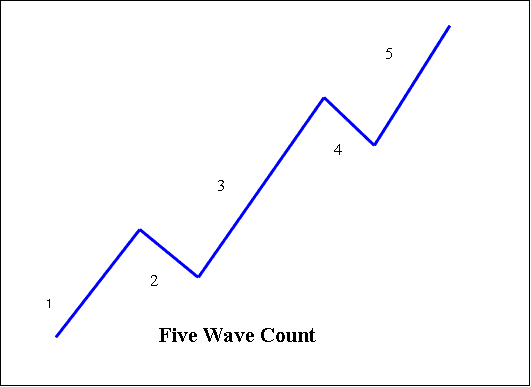

When this theory is applied to Gold, the assumption is that the market will advance in a pattern of five waves - 3 up moves, numbered 1, 3 and 5 - which are separated by 2 down moves, number 2 and 4. When the three upward moves (1, 3, 5) are combined with the two downward moves (2, 4), they form the 5 Wave pattern.

The trading analysis theory further holds that each five-pattern upward move will be followed by a downward move also consisting of a three-pattern down moves - this time, 3 down ones are not numbered but use the letters A, B and C. So as to differentiate these from the 5 ones for the upwards move.

5 and 3 Wave Pattern

The main trend will comprise of 5 moves while the market retracement will comprise 3 moves.

Five pattern (dominant trend) - uses 1, 2, 3, 4, 5

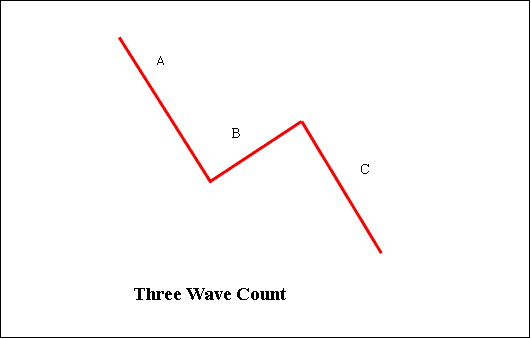

Three pattern (corrective trend) - uses A, B, C

This article shows you how to trade online markets using the Elliott Theory. The whole model is based on studying XAUUSD price charts. Technical analysts use it to spot trends, identify the waves, and figure out what XAUUSD prices are likely to do next.

By scrutinizing these formations on charts and applying the principles of Elliott Wave Theory, gold traders can strategically determine optimal entry and exit points based on anticipating likely market turning moments.

One of the easiest places to see this theory at work is on the market, where changing investor trading psychology is recorded in the form of trading price moves. If a trader can identify repeating patterns in xauusd prices, & figure out where these repeating pattern formation is compared to the Elliott setup counts then the online trader can predict where the prices are likely to head to.

Rules for Elliott Count in Gold Trading

Based on the common market shapes and things that happen in this trading idea, there are some rules for correct Counts:

- Wave 2 shouldn't go below the starting of Part 1.

- Wave three3 should be the biggest among Part 1, 3 & 5.

- Wave 4 shouldn't over-lap with Part 1.

Five pattern (dominant trend)

1: This is hardly noticeable when it starts. When a new rise in the market begins, news about the economy is usually bad. The old gold trend is still seen as strong. Experts keep lowering their predictions: a new trend probably does not seem powerful. Surveys show people are still pessimistic, and market prices could change a lot. Trading might increase a little as prices go up, but not enough to get the attention of many technical experts.

2: This one 2 corrects 1, but can never extend beyond the starting point of wave 1. Typically, the news is still bad. As prices retest the prior low, bearish sentiment quickly builds, "the crowd" mentality reminds all that the bear market is still in place. Still, some positive signals appear for those who are looking: volume should be lower during 2 than during 1, trading prices usually and generally do not retrace more than 61.80% of 1 part one gains. Price will reach a low that is higher than the previous low resulting in to a higher low.

Number 3 is generally the largest and strongest upward movement, bigger than 1 and 5. The news is now good, and experts who study the market start to increase their predictions. Prices go up quickly, and any drops do not last long or go very deep. Anyone wanting to buy when the price goes down a bit will probably miss out. When 3 begins, the news is still somewhat bad, and many traders still feel mostly negative: however, by the middle of part 3, many people will often start to agree that the market is now going up. Wave three goes higher than the highest point reached by wave 1.

Wave 4 is typically corrective in nature, often moving sideways for an extended period and usually retracing less than 38.20% of wave 3. Volume during this phase is significantly lower than in wave 3. This presents an opportunity for a trader to buy on a pullback, provided they understand the potential developments of wave 5. However, wave 4 can be frustrating due to its limited advancement in the broader upward trend.

5: This represents the final stage within the trajectory of the primary market trend. News sentiment is nearly universally optimistic, and widespread bullishness prevails. Unfortunately, this is frequently the point where the majority of average traders finally enter the market, just before the price peaks. Trading volume is often diminished in Phase 5 compared to Wave Three, and numerous momentum indicators begin to exhibit divergences (trading prices attain a new peak, yet the technical indicators fail to reach corresponding new highs). As a significant bullish market trend concludes, those attempting to predict a market top might even face ridicule.

Three Pattern (Corrective Trend)

A: Corrections are often much harder to identify than the impulse moves. In A of a bearish market, the economic fundamental news is generally still positive. Most analysts see the drop as a correction in a still active bull market. Some technical indicators that accompany A include increased trading volume, rising and implied volatility & possibly a higher open interest in selling/shorting.

B: Prices change direction and go up a little, and many think that the bullish trend, which ended a while ago, is starting again. People who know classical analysis might see the peak as the right shoulder of a head and shoulders pattern that shows a reversal. The amount of trading during B should be less than in A. By this time, the good reasons for buying are probably not getting better, but they most likely have not started to become bad yet.

C: Prices drop fast. Volume rises. By the third wave in C, most see the bear trend is set. Wave C often matches wave A or hits 1.618 Fib beyond A's low.

More Online Courses and Topics:

- How Can I Use Gold Price Channel Indicator?

- How Do I Trade the Market Training Tutorial Download?

- Bollinger Band-width Study of XAU USD Technical Data

- Configuring XAUUSD Stop Loss & Take-Profit on the MetaTrader 5 Platform

- Accumulation/Distribution Indicator Analysis for XAUUSD Trading Signals

- XAUUSD Trend-line Breakout Indicator MT4 Trade Platform

- What Happens after a Gold Dark Cloud Cover Candlestick Patterns?