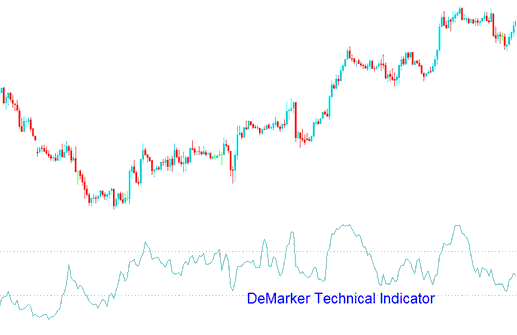

DeMarker Analysis and DeMarker Signals

Developed & Created by Tom Demark.

This technical tool has been engineered to mitigate the inherent weaknesses found in conventional indicators for identifying overbought or oversold market conditions.

The DeMarker is used by the Gold traders to predict potential market bottoms and tops by utilizing and using price info comparisons from one bar to the next.

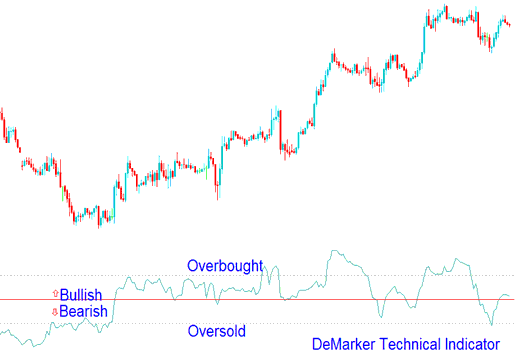

Analysis and How to Generate Trading Signals

This indicator functions similarly to other overbought/oversold tools. The overbought level is set at 70, while the oversold level is marked at 30.

Bullish Reversal Indication - When the DeMarker value drops below 30, anticipation should shift towards a bullish price reversal.

Bearish Reversal Trading Signal - When DeMarker rises above 70, the bearish price reversal should be expected.

Technical Analysis in Gold Trading

If you use a longer time frame to draw the Demarker, you'll be able to spot long-term price trends. If you use a shorter time frame, you can get into the market when the risk is lowest, and you can plan your transaction so it fits within the main trend.

Study More Tutorials and Topics: