CCI Gold Analysis and CCI Trading Signals

Developed & Created by Donald Lambert

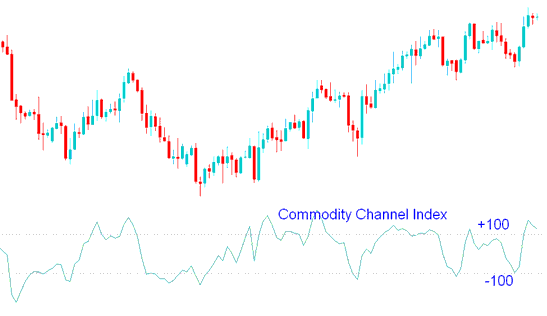

Commodity Channel Index measures the variation of a commodity xauusd gold price from its statistical mean(statistical average).

This technical indicator acts as an oscillator, fluctuating between high and low levels.

When the CCI registers a high value, it signifies that the xauusd price is significantly above its average level.

When the CCI is low, it indicates that the xauusd price is significantly below the average.

XAU/USD Analysis and How to Generate Trading Signals

Over-bought/ Over-sold Levels

The CCI typically oscillates between ±100.

Readings exceeding +100 indicate overbought conditions, suggesting an imminent market correction.

Readings from the indicator falling below the -100 mark suggest the market is over-sold and likely due for a correction.

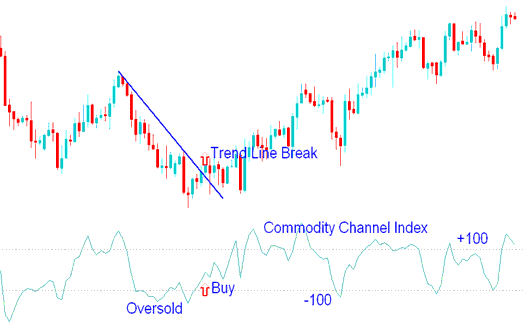

Buy Signal

If the CCI is in an oversold condition, indicated by levels below -100, a market correction is likely to occur.

The oversold levels will remain intact until CCI begins to move above -100.

When xauusd gold price begins moving above -100 then that is viewed as a buy.

The Commodity Channel buy signal should be combined with a trend line break signal to confirm the buy.

Buy Trade

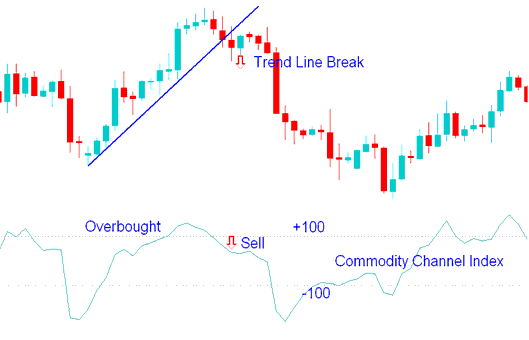

Sell Gold Signal

When the CCI registers in the overbought territory, specifically above +100, a market reversal is anticipated.

The overbought condition will persist until the Commodities Channel Index indicator starts descending beneath the +100 threshold.

When xauusd gold price begins moving below +100 then that's a interpreted as sell.

A sell signal generated by the Commodity Channel Index should ideally be confirmed by the concurrent breakout of a trend line to validate the selling indication.

Sell Trade

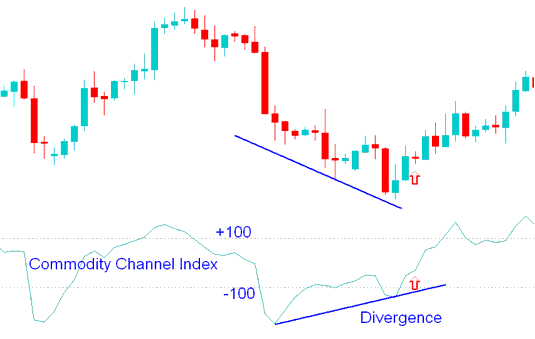

Divergence Trade

Bullish XAUUSD Trade Divergence Setup

A bullish divergence happens when price makes new lows, but the Commodities Channel Index doesn't drop below its previous low.

Divergence setups indicate potential upward corrections and serve as bullish signals for market analysis.

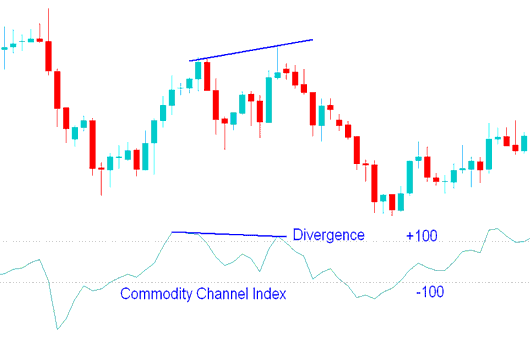

Bearish XAUUSD Trade Divergence Trading Setup

Bearish Divergence forms when the price is forming/making new highs while the CCI technical indicator is failing to surpass its previous high.

This is a bearish signal because the divergence trading setup will be followed by a downward market correction.

Technical Analysis in XAUUSD Trading

Study More Guides and Topics:

- How to Recognize a XAUUSD Candle

- A List of Gold Strategies for New Traders

- Ehlers RSI Indicator: How to Use It for Forex Buy Signals

- What XAU USD patterns are useful for Gold Day Trading strategies?

- Gold Price Action 1-2-3 XAU/USD Price Action Strategy in Gold Trading

- How to Handle Risks When Day Trading Gold plus Tips

- How to Modify a Trade Take Profit Order Within the MT5 Platform