Fibonacci Ratios Gold Analysis and Trading Signals

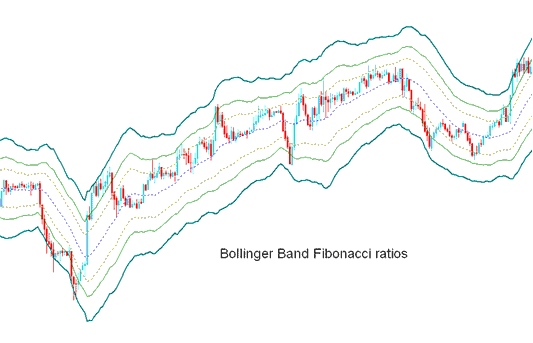

Derived from the initial Bollinger bands.

The Bollinger Fibonacci ratios are trading tools that show how much the price changes, but they don't use the usual way to measure the width of the lines. Instead, they use a smoother ATR multiplied by Fibo ratios of 1.618, 2.618, and 4.236.

Smoothed lines, adjusted by Fibonacci ratios, are subsequently incorporated by either adding to or subtracting from the Moving Average (MA).

This forms Three upper Fib bands and Three lower Fib bands

The middle band forms basis of the trend.

Gold Analysis and Generating Signals

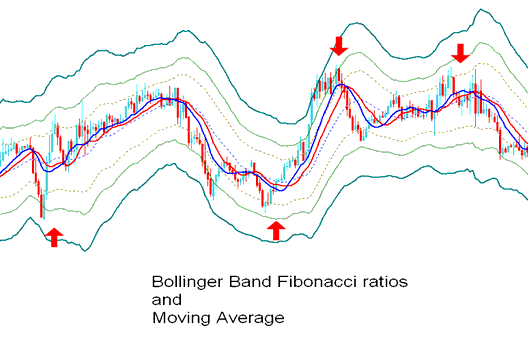

This indicator used to determine point of support and resistance for gold.

Lines below represent support points while those above are resistance zones.

Outermost bands provide the strongest resistance/support.

The inner most bands provide the least support/resistance.

The innermost band represents Fibo 38.2 % retracement level

The second band represents Fibonacci 50 percentage retracement level

The outermost band represents Fib 61.80 percent retracement level

This technical instrument serves to pinpoint specific junctures where momentum suggests a potential shift in the prevailing price direction (price retracement levels).

Price touching a line and reversing sparks an entry or exit signal.

Honestly, it's smart to pair your signal with other confirmation indicators like the MA. That extra confirmation makes your trading signal stronger - just like in the example below.

Analysis in Gold Trading

Study More Guides & Topics:

- How to Use Bar and Tab Charts for XAUUSD in MT5

- How do I use the MetaTrader 4 app on Android?

- What's a XAUUSD Engulfing Candlesticks Patterns in Gold?

- Instructions for Establishing a Demo Account for XAU USD Trading on MT4 Software.

- Best swing indicators for MT4 – a quick list.

- What Does XAU/USD Margin Level Mean on MetaTrader 5?

- Consequences When Margin Funds Allocated to XAUUSD Become Fully Utilized