Accumulation/Distribution Trading Analysis & Accumulation/Distribution Trading Signals

Created by Marc Chaikins

This indicator is used to assess the cumulative flow of money into and out of gold.

Originally used for stocks trading, when it comes to stocks trading "volume" is the amount of shares traded in a particular stock, this volume is a direct reflection of the money that is coming into and out of a stock.

The basic principle behind AD is that volume(or money flow) is a leading indicator of the xauusd trading price. (Volume precedes trading price).

Tick volume is the measure of xauusd trading price changes (ticks) received by a broker during a particular trading period/interval. Tick volume is incorporated by many brokers in their charting software.

Interpretation

This volume indicator is used to determine if volume is increasing or decreasing as the xauusd trading price on a chart is rising or falling.

UpGold Trading Trend

If the xauusd trading price on a chart is rising then the Accumulation/Distribution should also be rising. This portrays that the xauusd price move is being supported by volumes & the move upwards has strength and is sustainable.

If on the other hand trading price is moving up and the volumes are not, the strength behind the move is reducing: this creates divergence between price & indicator & warns of a possible move in opposite direction.

DownXAUUSD Trend

If the xauusd trading price on a chart is falling then the AD should also be falling. This portrays that the xauusd price move is being supported by volumes and the move downward has strength behind it.

If on the other hand trading price is moving down and the volumes are not, the strength behind the move is reducing: this creates divergence between trading price & AD & warns of a possible move in opposite direction.

Trading Analysis & Generating Trading Signals

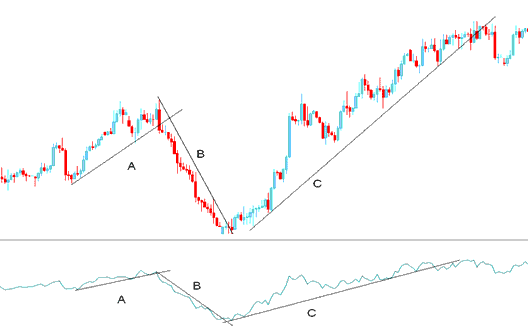

Below is example of a chart and the technical analysis explanation

From chart above we can separate the chart into 3 parts, part A, B and C.

A - Upward trendline on chart as well as on the Accumulation--Distribution

B - Downward trendline on chart as well as on the Accumulation--Distribution

C - Upward trendline on chart as well as on the Accumulation--Distribution

As long as the xauusd price & the indicator are moving in the same direction then the xauusd trading price move has enough momentum to continue heading in that direction as displayed above

XAUUSD Trend Line Break

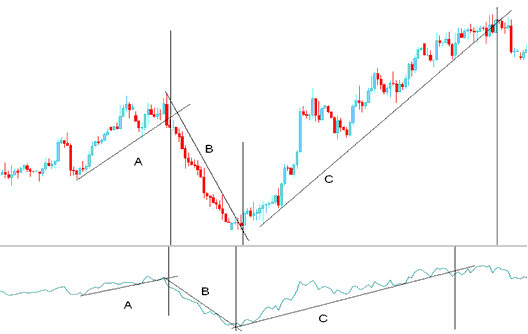

From the above chart we can see that once the trendline on the AD was broken then the xauusd price trend line was also broken.

Looking at the chart below we have added vertical lines to represent the points where the trend lines were broken, both on the xauusd price chart & the indicator.

Comparing the trendlines on the indicator & the xauusd trading price those of the AD were broken before those of the chart. This is because volume always precedes trading price.

Trading Signals

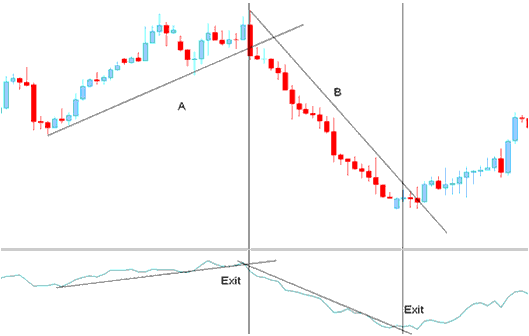

Exit

Exit trading signals are generated when the trendline on the Accumulation/Distribution is broken. A trendline break on the technical indicator warns of a possible reversal.

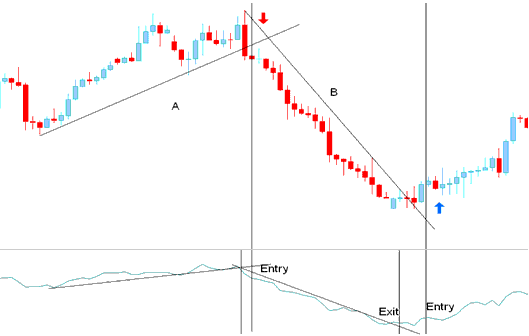

Entry

Once the trendline on the AD is broken it warns of a possible reversal in direction of the market.

However if we want to take a trade in the opposite direction it's always best to wait for a confirmation signal.

A confirmation signal is considered complete once both the indicator & the xauusd trading price breaks both their trend lines.

Entry Signal Generated by Trend Reversal