Inverted Hammer Candlestick - Shooting Star Candlestick - Inverted Hammer vs Shooting Star Candlesticks

Inverted Hammer Bullish Candlestick - Shooting Star Bearish Candlestick - Bullish vs Bearish Candles Setups

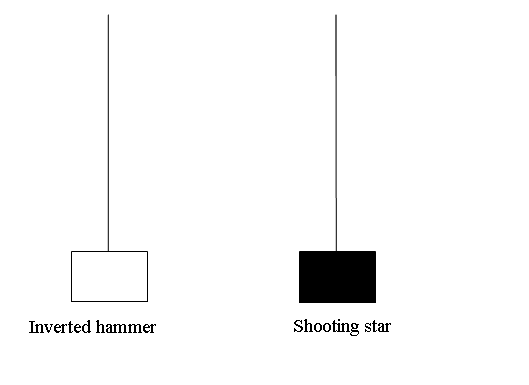

Inverted Hammer Candlestick Pattern & Shooting Star Candlestick Pattern look alike. These candlesticks patterns have a long upper shadow and a short body at the bottom. Their fill color doesn't matter. What matters is the point where they appear whether at the top of a market trend (star) or the bottom of a market trend (hammer).

Difference is that inverted hammer is a bullish reversal pattern while shooting star is a bearish reversal pattern.

Upward Trend Reversal - Shooting Star Candles

Downward Trend Reversal - Inverted Hammer Candlesticks

Inverted Hammer Candlestick Pattern & Shooting Star Candlestick Pattern Candle Sticks Setups

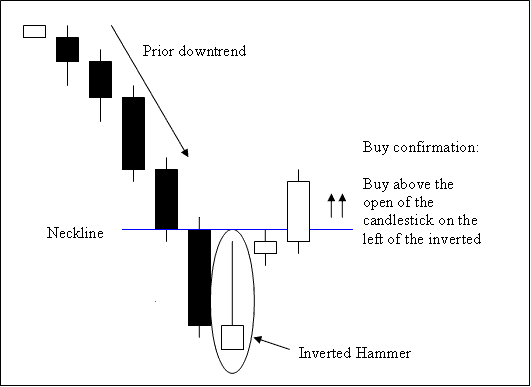

Inverted Hammer Forex Candle

This is a bullish reversal candle setup. It occurs at the bottoms of a Forex trend.

Inverted hammer occurs at the bottom of a downtrend and indicates possibility of a reversal of the downward Forex trend.

Inverted Hammer Forex Candle

Analysis of Inverted Hammer Candlestick Pattern

A buy is completed when a candlestick closes above the neckline, this is the opening of the candlestick on the left side of this pattern. The neckline in this case is a resistance zone.

Stop orders for the buy trades should be set a few pips below the lowest price on the recent low.

An inverted hammer is named so because it indicates that the market is hammering out a bottom.

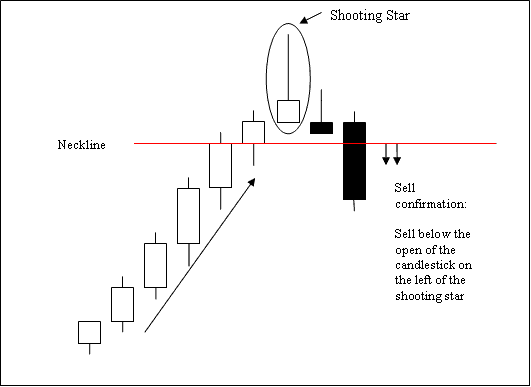

Shooting Star Candlestick

This is a bearish reversal candle pattern. It forms at the tops of a market trend.

It occurs at the top of an uptrend where the open price is same as the low & price then rallied up but was pushed back down to close near the open.

Shooting Star Candle

Technical Analysis of Shooting Star Candle Pattern

A sell is completed when a candlestick closes below the neck-line, this is the opening of the candlestick on the left side of this pattern. The neck-line in this case is a support level.

Stop orders for the sell trades should be set a few pips above the highest price on the recent high.

The Shooting Star candle-stick is named so because at the top of an upwards market trend this candlestick pattern looks like a shooting star up in the sky.