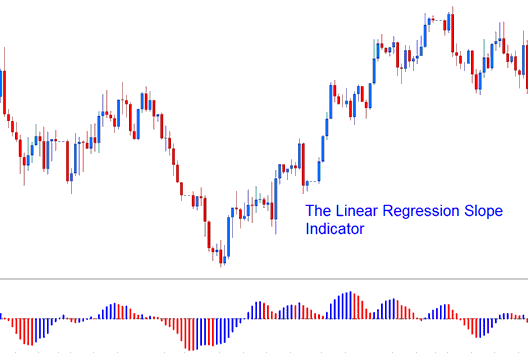

Linear Regression Slope Trading Analysis Signals

The Linear Regression Slope indicator calculates slope/gradient value of regression lines which involves the current price bar & the previous n-1 price bar (where n = regression periods)

This Indicator calculates this value and updates it for each price candlestick loaded in the price chart.

The Indicator is calculated from the Linear Regression Indicator. The linear regression plots the trend of the price chart over a specified duration of time and this market trend is determined by plotting a Linear Regression Trendline using the "least squares fit" method. The slope of this trend line is then calculated and this forms the linear regression.

Linear Regression Slope

The slope values are then smoothed by multiplying the raw slope indicator values by 100 and then dividing this value by the price

Linear Slope Regression = (raw value of slope * 100 / price).

The smoothing of the slope values is essential when comparing markets which are volatile & trade within wide price ranges for each price candle. The smoothed slope value will show the percent change in the price per every candlestick used to calculate the regression (best fit) line.

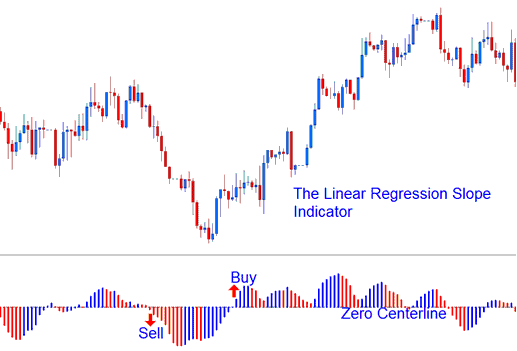

Forex Trading Analysis and How to Generate Trade Signals

- If the smoothing of the slope is 0.30, then the regression line is rising and adjusting at a rate of 0.30% for every candlestick.

- If the smoothing of the slope of -0.30, then the regression line is going down & adjusting at a rate of -0.30% for every candlestick.

The regression slope is displayed as a bi-color histogram that oscillates above & below zero center line. The center line that is used to generate forex signals is set at the 0 level.

- A rising slope (greater than the previous value of 1 candlestick ago) is displayed in the Blue/Upward Slope color,

- A declining slope (lower than the previous value of 1 candlestick ago) is displayed in the Red/Downward Slope color.

Technical Analysis in Forex Trading