SMI Technical Analysis & SMI Trading Signals

Developed by William Blau.

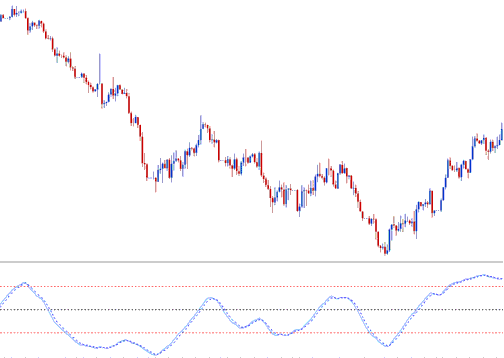

The SMI technical indicator is an adaptation of the classic Stochastic Oscillator indicator which smoothes out the stochastic indicator oscillations.

Construction of SMI

This indicator is calculated by comparing the price relative to the average of an n number of periods.

Then instead of plotting these values directly, smoothing using an Exponential Moving Average is applied and then the values drawn to form the SMI.

When the closing price is greater than the average of the range, the SMI will move up.

When the closing price is less than the average of the range, the SMI will move down.

This oscillator ranges between the values of +100 and -100, this indicator is also less prone to whipsaws compared to the stochastic oscillator.

Technical Analysis & Generating Trading Signals

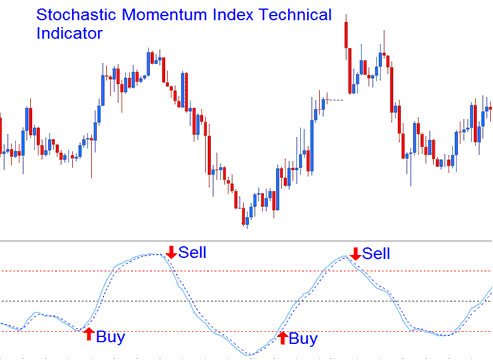

Buy & Sell Trading Signals/ Crossover Signals

The SMI can be used to generate buy & sell signals using the method shown below, Buy when the SMI is heading upwards and sell when its heading downwards.

Buy and Sell Signals/ Crossover Signals

Overbought/Oversold Level Energy Trading Crossovers

- Overbought levels above +40

- Oversold levels below -40

Buy signal is generated when this oscillator falls below oversold level and then rises above this level and starts to move upwards.

Sell Trading Signal is generated when this oscillator rises above overbought level and then falls below this level and starts to move downwards.

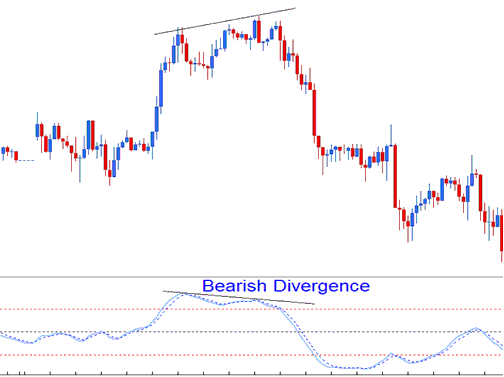

Divergence Energies

The example highlighted & described below displays a bearish classic divergence between the price & the SMI. When the SMI showed this divergence the price trend reversed and started to move in a downward direction.

Bearish Energy Trading Divergence