Kase Peak Oscillator and Kase DevStop 2 Technical Analysis & Trading Signals

Developed by Cynthia Kase

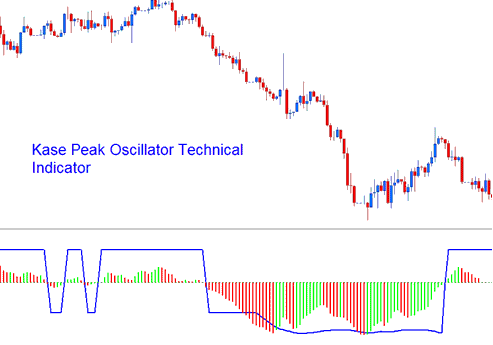

Kase Peak Oscillator technical indicator is used in the same way as other traditional oscillators, but oscillator is derived from a statistical evaluation of the trend; this statistical evaluation evaluates over 50 different trend lengths. The oscillator is capable of automatically adapting itself to the cycle length and volatility changes of the trend.

Kase Peak Oscillator Indicator

Histogram values below the center line signify bearish trends while values above the center line signify bullish values. Crossover signals are used as both entry and exit points.

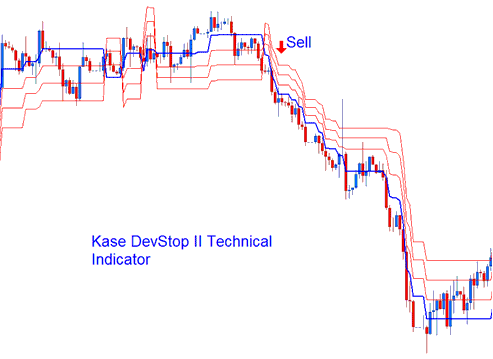

Kase DevStop II Indicator

Developed by Cynthia Kase

The Kase DevStop II calculates an average range, and the three standard deviations of this range.

Energies Analysis of Kase DevStop II

This Indicator is used to determine the realistic exit points for trades based on volatility, variance of the volatility and the volatility skew. This indicator plots 4 lines. The 4 lines are described as a Warning Line and 3 Standard Deviations Lines of 1, 2 and 3. These lines allow Energies traders to take profit or cut trading losses at the levels where the probability of a trade remaining profitable is very low, at the same time without taking more of a loss or cutting profit any time sooner than it is necessary.

Kase DevStop 2

The three red lines are used by traders to set exit levels or stop loss levels. The DevStop II is a trend following indicator.