Bollinger Bands Technical Indicator & Energies Price Volatility

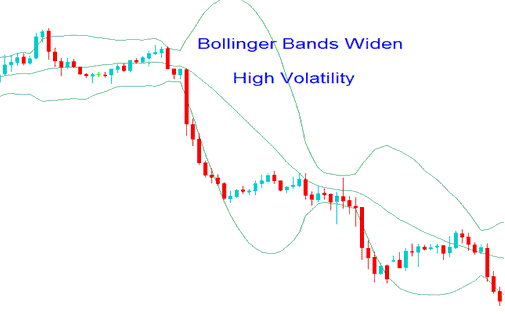

When energies price volatility is high; prices close far away from the moving average, the energies Bollinger Bands width increases to accommodate more possible energies price action movement which can fall within 95% of the mean.

Bollinger bands energies indicator will widen as energies price volatility widens. This will show as bollinger band bulges around the energies price. When the energies bollinger bands widen like this it is a continuation energies pattern and energies price will continue moving in this direction. This is normally a continuation energies signal.

The Bollinger bands energies indicator example illustrated and explained below illustrates the Bollinger bulge.

High Price Volatility - Energies Trading Bollinger Bands Indicator - Bollinger Band Bulge

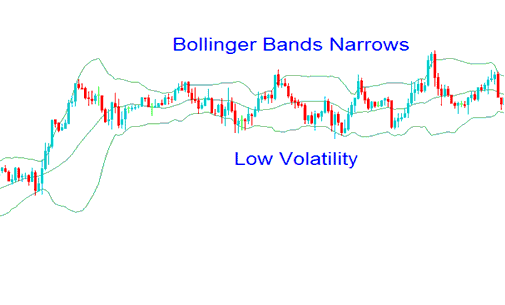

When energies price volatility is low; prices close closer towards the moving average, the width decreases to reduce the possible energies price action movement which can fall within 95% of the mean.

When energies price volatility is low energies price will start to consolidate waiting for energies price to breakout. When the energies bollinger bands indicator is moving sideways it is best to stay on the sidelines and not to place any trades.

The Bollinger bands indicator example is shown below when the energies bollinger bands narrowed.

Low Price Volatility - Energies Trading Bollinger Bands Indicator - Bollinger Bands Squeeze