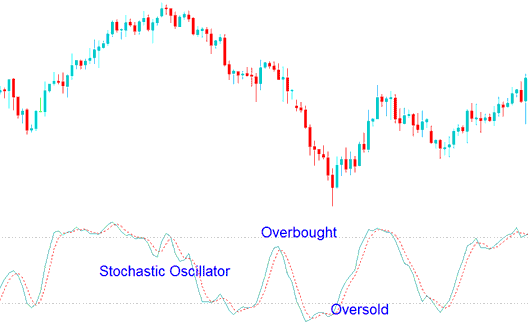

How Stochastic Oscillator Technical Indicator Works

The Stochastic oscillator commodity indicator uses time periods to calculate the fast & slow lines. The number of time periods used to calculate the %K & %D line depends on what purpose a trader is using the Stochastic oscillator commodity indicator for.

- A trader using the Stochastic oscillator commodity indicator in combination with a trend indicator to see overbought and oversold levels, one-can use periods 10 periods.

- The default period used by stochastic commodity oscillator indicator is 12.

Traders should not use stochastic indicator alone for making commodity decisions, but should use this Stochastic oscillator commodity indicator in combination with other commodity technical indicators.

In ranging markets this Stochastic oscillator commodity indicator can be used to show oversold/overbought areas as potential profit taking points when trading the market.

Oversold & overbought commodity levels by default are 20 and 80, but other commodity traders use 30 & 70.

To look for "overbought" region at the indicator's 80% stochastic commodity oscillator mark is used

To look for "oversold" region 20% stochastic commodity oscillator mark is use.

The overbought & oversold levels are displayed as dotted horizontal lines on the stochastic oscillator commodity indicator. These levels can also be adjusted to the 30 and 70 levels.

Overbought & Oversold Levels on Stochastic Oscillator Indicator