RSI Swing Failure Trade Setup

RSI commodity swing failure can be a very accurate method for trading short term commodity moves. It can also be used for trading long term trends but it is best suited for short term commodity especially for those traders that trade reversals.

The RSI swing failure swing commodity setup is a confirmation of a pending market reversal. This commodity swing failure setups a leading breakout signal, it warns that a support or resistance level in the market is going to be penetrated. This commodity setup should occur at values above 70 for an upward trend and values below 30 in a downward commodities trend.

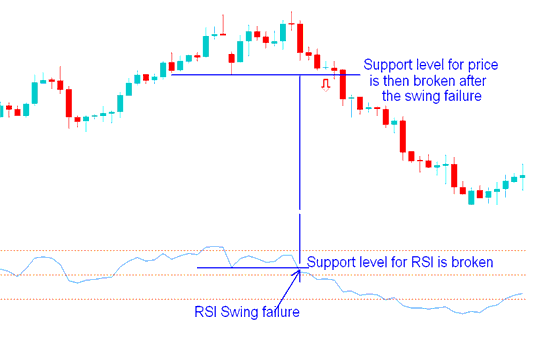

Swing Failure In an Upward Commodities Trend

If the commodity RSI Technical Indicator hits 79 then pulls back to 72, then rises to 76 and finally drops to below 72 this is considered a failure swing commodity RSI setup. Since the 72 level is an RSI support level and it has been penetrated it means that commodities price will and follow & it will penetrate its support level.

In the example illustrated & described below, the commodity RSI indicator hits 73 then pulls back to 56, this is a support level. The indicator then rises to 68 and then drops to below 56, thus breaking the support level. The trading price then follows afterwards breaking it support level. The commodity RSI swing failure is a leading signal and it is confirmed when commodities trading price also breaks it support level. Some traders open trades once the swing failure is complete while other traders wait for commodities trading price confirmation, either way it is for a trader to decide what work best for them.

Commodity Trading RSI Swing Failure Setup in an Upward Commodities Trend

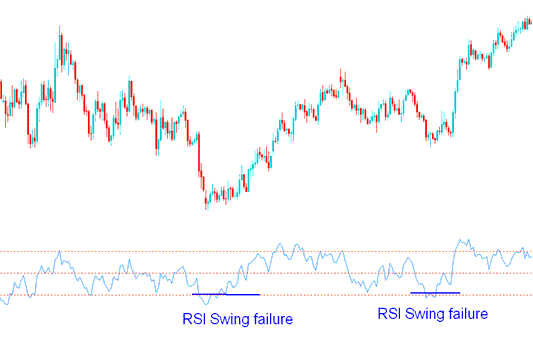

Swing Failure In a Downwards Commodities Trend

If the commodity RSI Technical Indicator hits 20 then pulls back to 28, then falls to 24 and finally penetrates above 28, this is considered a failure swing setup. Since the 28 level is an RSI resistance level and it has been penetrated it means that commodities trading price will & follow and it will penetrate its resistance level.

Commodity Trading RSI Swing Failure Setup in a Downward Commodities Trend