MA Support and Resistance Levels

MAs can be used as points of support and resistance on charts.

When price reaches the moving average, the Moving Average level can act as a point of support or resistance for the price.

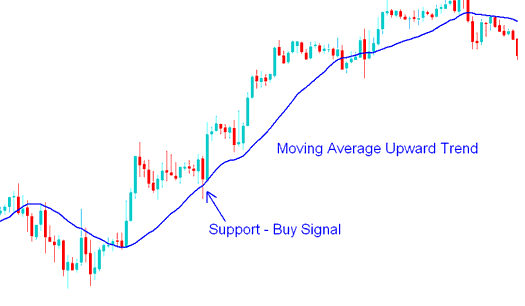

Buy Trading Signal

If price is on an upward commodity trend & starts to retrace, then most traders might wait to buy at a better price when the price hits a support level. Commodities Traders will sometimes use the Moving Average to determine the support level.

A buy signal is generated when price hits the Moving Average, turns and starts moving in the upward commodity trend direction. The commodity signal is confirmed when price closes above the Moving Average. Because many traders use the moving averages to generate commodity signals, price will normally react to these levels.

A stoploss should be set just below the Moving Average commodity Indicator. Ideally it should be set a few pips below the previous low.

Buy Signal - How to Trade Commodity with Moving Average Strategy

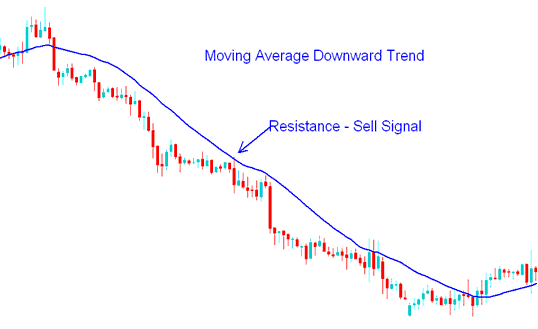

Sell Trading Signal

If the price is on a downward commodity trend & starts to retrace, then most traders might wait to sell at a better price when the price hits a resistance level. Commodities Traders will sometimes use the Moving Average to determine the resistance level.

A sell commodity signal is generated when price hits the Moving Average, turns and starts moving in the downward commodity trend direction. The commodity signal is confirmed when price closes below the Moving Average. Because many traders use the moving averages to generate commodity signals, price will normally react to these levels.

A stop loss should be set just above the commodity moving average indicator. Ideally it should be set a few pips above the previous high.

Sell Signal - How to Trade Commodity with Moving Average Strategy

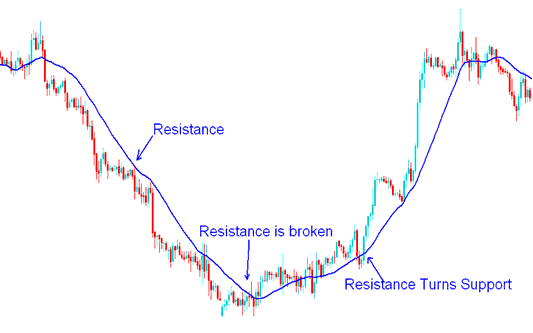

Resistance Level turns Support Level

In Commodities Trading - When a resistance level is broken it turns into support and vice versa.

This happens when the fundamentals of a trend change and consequently the direction of a commodity. Direction change is reflected by the moving average commodity technical indicator, the direction is confirmed when resistance level turns into support area or vice versa (when support level turns into resistance area)

Resistance Level turns Support Level - Moving Average Trading Strategy Example