Types of Commodity Trading Moving Averages

There are four types of commodity moving averages:

- Simple commodity moving average

- Exponential commodity moving average

- Smoothed commodity moving average

- Linear weighted commodity moving average

The difference between these 4 commodity moving averages is the weight assigned in to the most recent commodities trading price data.

Simple Moving Average

Commodity Trading SMA indicator applies equal weight to the commodity data used to calculate the simple moving average and is calculated by summing up the commodities trading price periods of a commodity chart and this value is then divided by the number of such commodities trading price periods. For example commodity simple moving average 10, adds the commodities trading price data for the last 10 trading price periods & divides them by 10.

Exponential Moving Average

Commodity Trading EMA indicator applies more weight to the most recent commodities trading price data and is calculated by assigning the latest commodities trading price values more weight based on a percent P, multiplier that is used to multiply and assign more weight to the latest commodities trading price data.

Linear Weighted Moving Average

Commodity Trading LWMA indicator moving averages applies more weight to the most recent commodities trading price data and the latest data is of more value than earlier commodities trading price data. Linear Weighted commodity moving average is calculated by multiplying each of the commodity closing commodities trading prices within the series, by a certain weight coefficient.

Smoothed Moving Average

Commodity Trading SMMA Indicator is calculated by applying a smoothing factor of N, the smoothing factor is composed of N smoothing for N trading price periods.

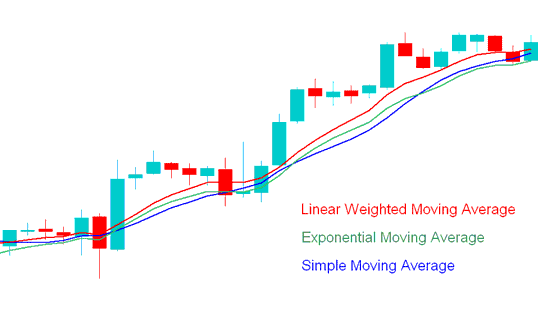

The chart example illustrated and demonstrated below portrays SMA, EMA and LWMA. The SMMA commodity moving average is not commonly used so it is not shown below.

The LWMA commodity indicator reacts fastest to price data, followed by the EMA and then the SMA.

SMA, LWMA, EMA - Types of Commodity Trading Moving Averages - SMA, EMA and LWMA

Day Commodity Trading with Exponential and Simple Moving Averages

The SMA and EMA commodity moving averages are the most commonly used Moving averages to trade commodity. Whereas the EMA commodity moving average has a more sophisticated method of calculation, its more popular than the SMA commodity moving average.

Simple Moving Average is the arithmetic mean of the closing commodities prices in the commodities trading price period based on the set time period where each time period is added and then it is divided by the number of time commodities trading price periods chosen. If 10 is the commodities trading price period used the commodities trading price for the last ten commodities trading price periods added up then it is divided by 10.

SMA commodity indicator is the result of a simple arithmetic average. Very simple and some Commodities traders tend to associate with the trend since it closely follows commodities price action.

EMA on the other hand uses an acceleration factor and it is more responsive to the commodities trend.

The SMA commodity moving average is used in charts to analyze commodities price action. If the commodities price action in more than 3 or 4 time commodities trading price periods the SMA then it's an indication that long commodities trades should be closed immediately and the bullish momentum of the buy commodity trade is waning.

The shorter the SMA trading price period the faster it is to respond to trading price change. SMA commodity indicator can be used to show direct information regarding the trend of the market and the strength by looking at its slope, the steeper or more pronounced slope of the SMA is, the stronger the Commodities trend.

The Exponential Moving Average is also used by many commodity traders in the same way but it reacts faster to the market moves and therefore it is more preferred by some commodities traders.

The SMA and EMA can also be used to generate entry and exit points when commodity. These Moving averages can also be combined with Fibonacci and ADX indicators to generate confirmation the signals generated by these moving averages.