MACD Indicator Crossover Trading Signals

MACD Center line crossovers generate trading signals using the center line mark. The sentiment of the trading market can be confirmed using the MACD center line crossovers. MACD commodity crossover above the center line mark generates bullish trading market sentiment while cross-over below the center line generates bearish commodity market sentiment.

- When the Fast-line crosses below MACD Line (not center mark) it shows market momentum is slowing - this is not a reversal signal or a sell signal, wait for center mark cross-over.

- When the Fast line crosses above the MACD Line (not center mark) it shows the commodity market momentum is slowing - this is not a reversal signal or a buy signal, wait for center mark cross-over.

- The Center-Line crossover commodity signals will be the best trading signals for confirming buy & sell signals.

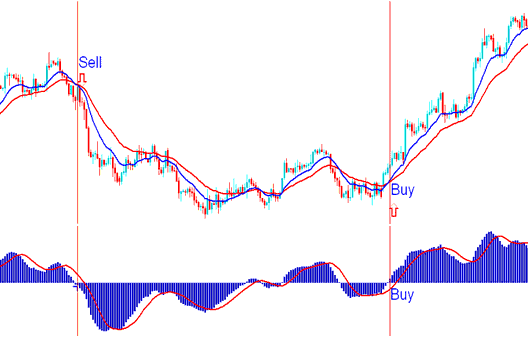

Using the Commodity Trading chart in the commodity example illustrated and demonstrated below, when MACD fast line crossed below the zero center mark, the sell signal was confirmed and the commodity market sentiment changed to bearish - downwards commodities trend.

Also in the commodity example illustrated and explained below when MACD fast line later crosses above zero center mark, a buy signal was generated and the commodity market sentiment changed to bullish - upwards commodities trend.

MACD Zero-Line Mark Crossover - Precisely When a Sell Signal and Buy Trading Signal are Generated

Oscillation of the MACD Indicator

The MACD indicator is an oscillator that moves up and down around a zero center line mark. The center-line is the neutral measurement, values above zero will indicate bullish trading market trend while values below indicate bearish trend.

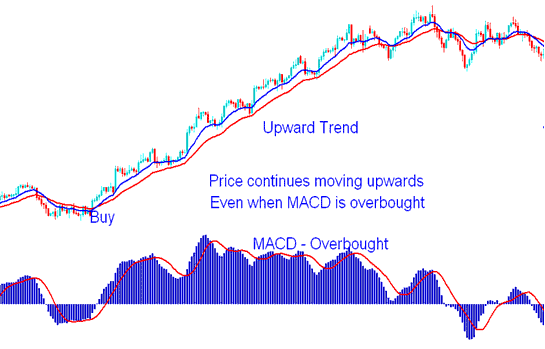

The MACD indicator is also used to indicate overbought and oversold levels. When the MACD reaches overextended levels, then a commodity instrument is overbought or oversold. However, in a strong upward trending market commodities prices will stay overbought in this case it's better to buy.

Also in a strong down trending commodities trading market its better to sell, because prices will stay in the oversold region for a long time.

Overbought conditions occur above the zero line while oversold conditions occur way below the zero mark.

MACD Overbought Region - Trend Continuation Signal