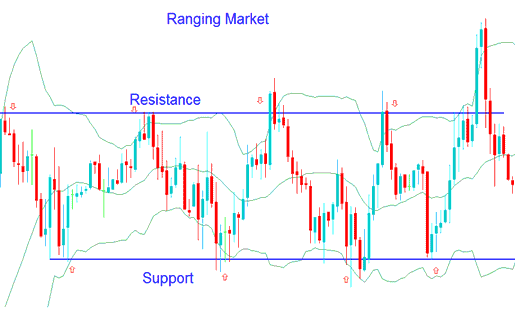

Bollinger Bands Trading Price Action in Ranging Trading Markets

Bollinger Bands Commodities Indicator is also used to identify periods when a market trend is overextended. The guidelines below are considered when applying this indicator to a sideways trend.

Bollinger Bands Commodities Indicator is very important because it is used to give signals that a trading price break out may be upcoming.

During a trending market these techniques do not hold, this only holds as long as Bollinger Bands are pointing sideways.

- If the market price touches the upper band it can be considered overextended on the upside - overbought.

- If the market price touches the lower band the price can be considered overextended on the bottom side - oversold.

One of the uses of Commodity Trading Bollinger Band indicator is to use the above overbought and oversold commodity guidelines to establish buy & sell targets during a ranging commodities market.

- If commodities price has bounced off the lower band crossed the center-line moving average then the upper band can be used a sell level.

- If commodities price bounces down off the upper band crosses below the center moving average the lower band can be used as a buy level.

Trading Bollinger Bands in Ranging Trading Markets - Bollinger Bands Method

In the above ranging market the instances when the trading price hits the upper or lower bands can be used as profit targets for long/short trade transactions.

trades can be opened when the market hits the upper resistance level or lower support level. A stop loss order should be placed a few pips above or below depending on the trade opened, just in case the price action breaks-out of the range within these Bollinger bands.