Candlesticks CFDs Chart Setups

Candlesticks Consolidation Pattern and Candlesticks Continuation Pattern

Depending on the size and shape of a CFD Trading candle it is possible to determine strength of buyers or sellers. Likewise it is also possible to determine underlying weakness of the buyers and sellers.

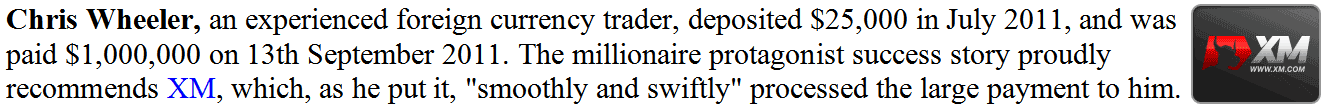

Long Body CFDs Trading Candlesticks

Candlesticks with long bodies show that there were a lot of buyers/sellers, depending on the color of the candlesticks.

When price makes a huge move from the opening price to the closing price it shows the strength of buyers/sellers.

Long Blue Candlesticks - Strength of Buyers

Long Red Candlesticks - Strength of Sellers

Long Body Candles

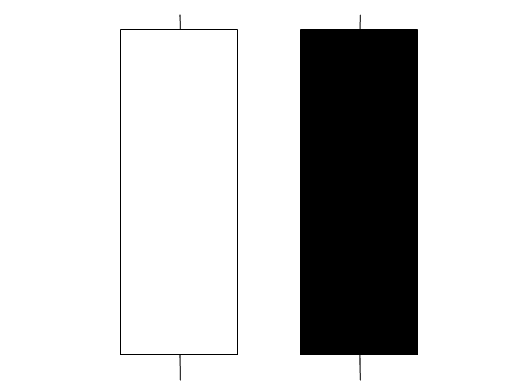

Short Body Candlesticks

Candlesticks with short bodies show that there were not so many buyers/sellers and the price did not move much from the opening price to the closing price.

These show that the buyers/sellers were not very strong.

Short Body Candles

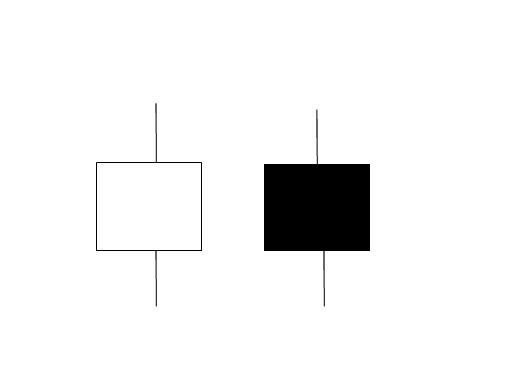

Marubozu Candlestick

Marubozu are long candles that have no upper or lower shadows, Like ones displayed below.

Marubozu CFDs Candlesticks

Marubozu are continuing candle-stick patterns which show price is going to continue in same direction as that of the marubozu candle. The marubozu can be white/blue or Black/red depending on the direction of the trend.

Marubozu Candlesticks

White marubozu - the open is also the low & the close is also the high.

Marubozu means there were no retracements during that price period & therefore portrays that buyers were in total control of the price.

White Marubozu is a continuation pattern meaning that the next candle is likely to continue in the same upwards trend direction.

Black marubozu - the open is also the high & the close is also low.

Marubozu means there were no retracements and therefore shows that sellers were in total control of the price.

Black Marubozu is a continuation pattern meaning that the next candle is likely to continue in the same downwards trend direction.