Entry Limit Orders: Buy Entry Limit and Sell Entry Limit

Limit order definition - Entry limit is an order to buy or sell a CFD at a certain price which is a retracement level where price is predicted to pullback to before resuming the original trend. traders use them to buy or sell at better market price. These types of orders are provided for in most online platforms, for our example we will use MetaTrader 4 trading platform.

An entry of this type can be used to buy below the cfd market level (up cfd trend market retracement) or sell above the cfd market level (down trend market retracement).

Buy limit - When buying, your entry buy limit is executed when the cfd market falls to your set price. ( retraces down )

Sell limit - When selling, your entry sell limit is executed when the cfd market rises to your set price. ( retraces up )

Entry orders are placed by traders when they expect price to bounce back after reaching this level.

- Entry Buy Limit Orderbuy at a level below the current market price.

- Entry Sell Limit Ordersell at a level above the current market price.

Buy Entry Limit Example

In the cfd example shown below, the buy limit order was placed to buy at a cfd price below the prevailing market price. Point Marked B is the point at which it was set.

Limit buy order entry placed to buy below the prevailing market price

The price then retraced and went down to hit buy entry limit, and afterwards price continued to move upward in direction of the original CFD Trading upwards trend. When limit buy order was hit it changed in to a buy.

Price hits buy limit, order now changes to a buy

Sell Entry Limit Order

In the cfd example shown below a the sell entry limit was placed to sell at a cfd price above the prevailing market price. This is the level for the price retracement.

Entry limit sell order placed to sell above the prevailing market price

The price then rallied, went up to hit sell entry limit, and afterwards price continued to move downwards in direction of the original CFD Trading downward trend.

Price hits sell limit, order now changes to a sell

When cfd quote hit the set level the order changed to a sell, this is therefore a nice technique to buy or sell at a better price after a retracement.

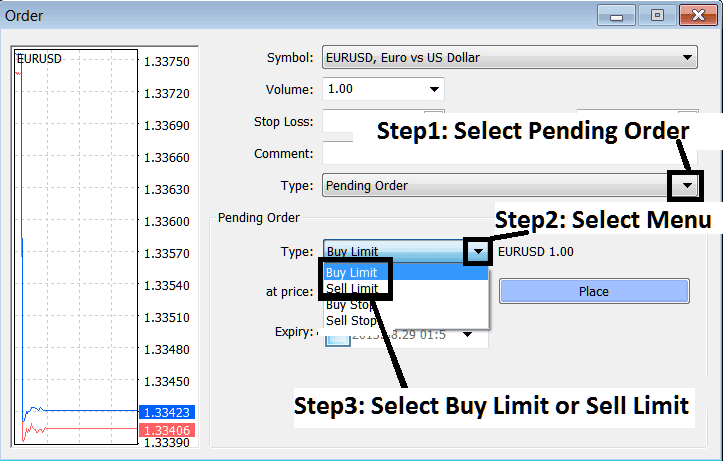

Setting Buy and Sell Limit CFDs Orders in MetaTrader 4 Software

To set up these cfd orders in MT4 platform, Right Click on CFD Trading chart>>> Select 'Trading">>> Then Select "New'>>> Then on the pop up that appears (illustrated & shown below), under label "Type" select option of "pending" instead of "market execution">>> Under the pending order options choose the pending order type: For This trade select either "Buy Limit Order" or "Sell Limit CFDs Order" depending on whether you want to place a pending buy or sell.

Setting Buy and Sell Limit CFDs Orders on MetaTrader 4 Software

Sometimes, setting the point value to place your trade can be tricky, setting to far might mean your entry market limit not getting executed, the best tool to use is Fibonacci retracement indicator and use the 38.2 % retracement levels. This retracement level is watched by many traders and entry orders tend to crowd at this level, therefore the best odds to catch a trade would be presented by using the 38.2% Fibonacci retracement level.

Fibonacci Retracement Tutorial - CFDs Fibonacci Retracement Guide

Tip: In CFD online trading, If you want to set a good take profit level (not retracement level, take profit level) for your trades you can use the Fibonacci expansion 100% level for the best take profit area. To Read more on CFDs Fibonacci Retracement and Fibonacci expansion use the right navigation menu section Technical Analysis.

CFD Fibonacci Expansion Tool Tutorial - CFD Fibonacci Expansion Tool Guide