T3 Moving Average CFD Technical Analysis & T3 Moving Average CFD Signals

T3 uses a Smoothing factor/technique to produce trading signals that are similar to those of the moving averages, but are more accurate than those of the MA. The T3 is a modification of method used to calculate the original Moving Average and it has a smoother curve and it does not lag the cfd market as much as the MA. This Indicator follows price action and adjusts itself to the direction of the market.

CFDs Analysis & How to Generate Signals

The T3 moving average is similar to the original MA, & it can be traded in the same way as the original Moving Average indicator.

Moving Average CFD Trading Cross-over Trading Signal

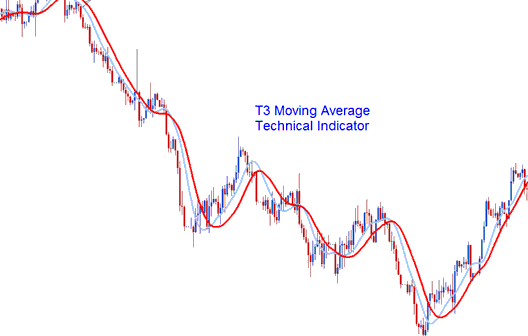

This Technique involves using 2 T3 Moving Average & generating trading signals when the 2 cross each either upwards generating an upwards trend signal or cross downwards generating a downwards trend Signal.

Crossover Signal

Crossover Signal

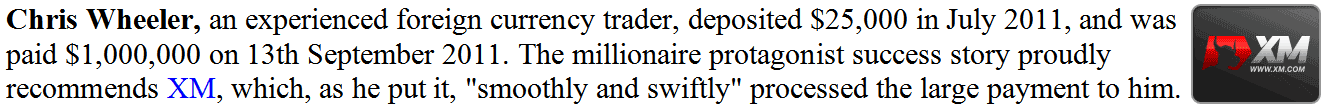

Bullish Trend - Prices are bullish as long as price action remains above the indicator. When this move happens it implies that prices are bound to continue moving upwards.

Bearish Trend - Prices are bearish as long as price action remains below the T3 Average. When the price is below the indicator it implies that price is bound to continue moving downwards.

Whipsaws - This is a smoothed indicator which is not prone to giving out whipsaws, since it is smoothed it's less responsive to price spikes, therefore a price spike will not skew the data used to calculate and draw it.