Bollinger Bands CFD Analysis and Bollinger Signals

Developed by John Bollinger

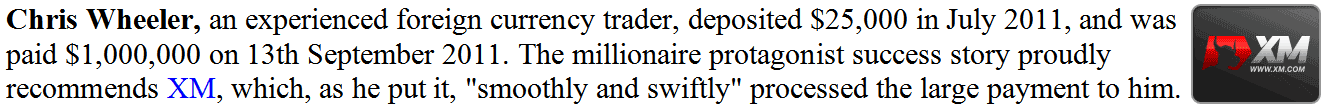

Bollinger bands are formed by 3 lines. Middle line is a Moving Average - 20 period Simple Moving Average.

The bands are then drawn at a distance away from the moving average These are the bands that form the lower & upper lines.

The distance where the bands are drawn is determined by another indicator called the standard deviations. Standard deviation is a measure of volatility in the market or that of a cfd.

Since the cfd market volatility keeps on changing, the standard deviation will keep varying, and since Bollinger bands are drawn using the standard deviation the distance of the bands will keep on adjusting themselves to the cfd market conditions.

When the cfd markets become more volatile, the bands widen and they contract during less volatile periods.

The 3 Bands are designed to encompass the majority of a cfd price action. The middle band forms the basis for the trend, typically a 20-periods simple moving average.

This band also serves as the base for the upper & lower bands. The upper band's and lower band's distance from the middle band is decided by volatility. Upper band is drawn at +2 standard deviationss above the middle band while the lower band is drawn at -2 standard deviationss below the middle band.

CFDs Analysis & Generating Signals

- Bands provide a relative definition of high & low

- Used to identify periods of high & low volatility

- Used to identify periods when prices are at extreme areas

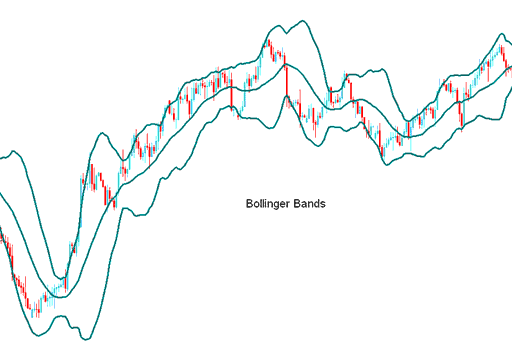

the Squeeze

The bands tighten as volatility lessens, this identifies periods of consolidation. Sharp price breakouts tend to occur after the bands tighten.

Consolidation Pattern

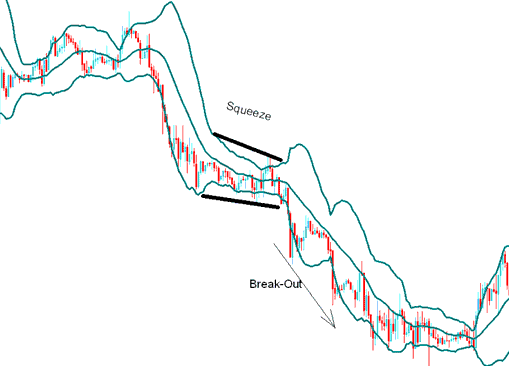

the Bulge

If prices break through the upper or lower band move outside the bands a continuation of the current trend is expected.

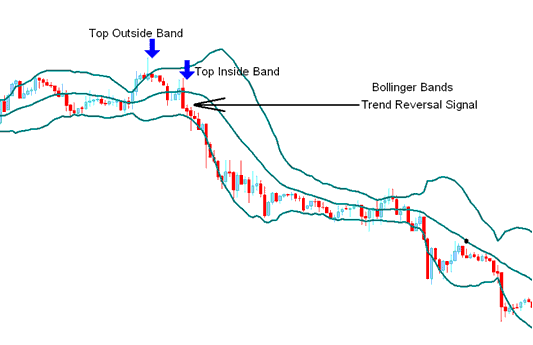

Double Top and Double Bottoms

Bottoms and tops made outside the bands followed by bottoms and tops made inside the bands call for reversals in the trend

The Head Fake - CFDs Trading Whipsaw

Traders should be on look out for false breakouts known as whipsaws or head fakes.

CFD Price often breaks out in one direction immediately following the Squeeze causing many traders to think the break out will continue in that direction, only to quickly reverse & make the true, more significant breakout in the opposite direction.

Traders acting quickly on the initial breakout often get caught on the wrong side of the price action, while those traders expecting a "false breakout" can quickly close out their original position and enter a trade in direction of the reversal. It is always good to combine Bollinger bands with other confirmation Indicators.