How do you set both stop loss and take profit orders on the MT4 platform?

As an XAU/USD trader, accessing the trade modification window is achieved by clicking the 'Modify Trade Order' button, which will display the subsequent pop-up window shown here. These identical settings are also accessible when a trader initiates a 'New Order'. Both the 'New Order' button and the 'Modify Order' button utilize the same configuration options for setting parameters such as:

- Stop Loss Order

- Take Profit Order

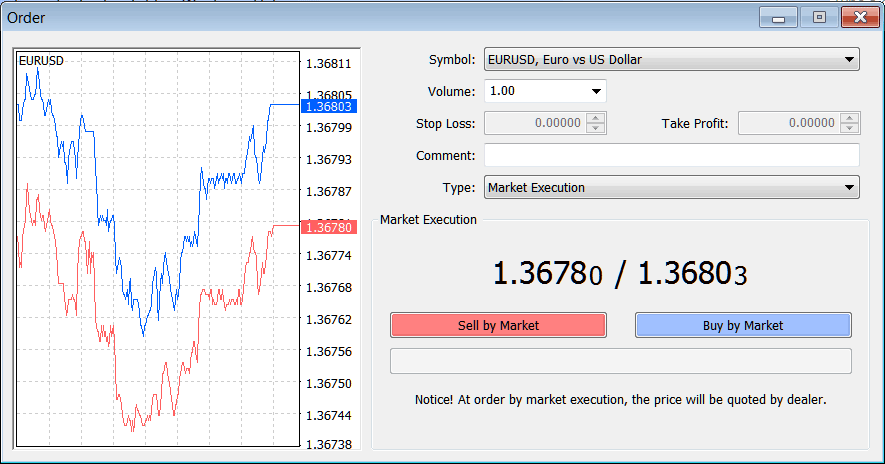

This popup has all the settings for changing a trader's order, including the option to set a stop loss and the option to set a take profit, as shown below.

MetaTrader 4 Stop Loss Orders and Take Profit Orders Setting Button Window

Gold Stop Loss Orders Explained - Tips for Setting Them

StopLoss is a type of XAUUSD trading order placed after opening a Gold trade that is meant to cut losses if the market moves against you.It is a predetermined point of exiting a losing transaction & it's meant to control losses in trading.

A stop loss is an instruction given to your broker that will automatically terminate your trading position if the Gold price reaches a predefined level. Once this set threshold is met, your open position is closed out immediately to limit any further trading losses incurred.

Stop loss orders are specifically implemented to cap the maximum potential financial loss by automatically terminating the trade if a predetermined price point specifically adverse to the trade's direction is encountered.

For example, someone might buy XAUUSD at 1200.50 and set a stop loss at 1200.00. If the XAUUSD Gold price goes against you and reaches 1200.00, the stop loss will be activated, and the trade position will be closed, limiting the loss to 50 points (pips).

No matter what others tell you, there is no question about whether these orders should be used or not - they should always be used, no doubt.

One of the most difficult things in Gold metal trading is setting these stop losses. Put the stoploss order too close to your entry price & you are liable to exit the trade transaction due to and because of random price volatility. Place it too far away and if you are on the wrong side of the trend, then a small loss could turn in to a large one.

Detractors often highlight several drawbacks associated with these specific order types: by setting them, you are effectively committing to selling at lower prices rather than higher ones should your active trade move adversely.

Critics say stop-loss orders risk closing a trade right before the market turns your way. Many traders know this frustration. They set the order, watch the price dip to it or just below, then see it follow their first trend idea. A winning trade slips into a loss.

Seasoned traders uniformly employ stop losses, as they constitute an indispensable element of the discipline necessary for success, capable of preventing a minor loss from escalating into a major one. Moreover, by consistently setting these stop losses upon trade entry, this critical decision is made at the moment you possess the least bias regarding the actual market conditions in XAUUSD, because the most objective analysis precedes transaction initiation. Once in the market, a trader's perspective often shifts due to an inherent bias toward the trade's chosen direction.

Unexpected news may burst out of the blue and have a major influence on the XAUUSD Gold price: therefore, it is quite important to have a stop loss. Early in a trade that is going against you, it is better to reduce your trading losses right away rather than wait for it to turn into a large one. Once more, you are most objective if you set your stops as you enter a trade.

A key question is precisely where to place this order. In other words, how far should you as a trader place and set this below your purchase price? Many traders will tell you to set a predetermined - maximum acceptable loss, an amount based on your equity balance rather than use indicators of the Gold pair in question.

Professional money managers advice that you should not lose more than 2% of your equity on any 1 single Gold trade transaction. If you've got $50,000 in capital, then that would mean that the maximum loss that you should set for any one trade transaction is $1,000 dollars.

If you bought 10 standard lots of a XAUUSD pair, then you would limit your risk to no more than $1,000 dollars. In that case you would set your stop loss at 100 pips (points) & would have $49,000 left if you exited the trade position at the maximum loss allowed. The topic of equity management and risk management is wide and it is covered & discussed/explained under equity management topics.

Intro to Money Management and Key Techniques

What to Consider When Setting Stop Losses

The most important question is how close or how far this order should be from the price where you entered the trade transaction position. Where you set will depend on several different factors:

There are no strict rules for determining where to place stop-loss orders on an XAUUSD price chart. Instead, general guidelines are followed to help position these orders accurately.

Some of the broad rules used are as follows: 1. Risk - What is the maximum amount of money a trader is prepared to lose on a single transaction? In general, a xauusd trader should never risk losing more than 2% of their entire account balance on any one Gold trade.

2. Volatility - this is about how much the XAUSUD price changes each day. If the XAUUSD price often goes up and down a lot, like 100 pips or more each day, then you can't use a very close stop loss. If you do, you'll be kicked out of your trade because of the usual price changes.

The risk-reward ratio gauges potential risk against reward. Good market conditions allow you to add more space to your trade. But if the market stays in a narrow range, opening a position without a close stop gets dangerous. Skip the trade in that case. The odds do not favor you, and tight stop losses do not promise gains. Wait for a stronger setup next time.

4. Position size - If you risk too much on a trade, even tiny price changes will greatly impact your money. This means you need a very close stop loss, which might get hit easily. It's usually better to use a smaller position size, giving your Gold trade more room to move by setting a reasonable stop loss level, while also lowering the risk.

5. Account capital - Low funds limit your stop losses. A big position size forces tight stops. If so, check if you have enough money to trade XAUUSD at all.

6. Market conditions - When prices are trending upward, setting a tight stop-loss may not be necessary. However, if market conditions are choppy with no clear direction, it's better to either set a tight stop-loss or avoid opening any positions altogether.

7. Chart Time Frame - the bigger and larger the chart time-frame you use to trade Gold, the bigger and larger the stop loss set should be. If you were a scalper your stop losses would be tighter than if you were a day trader or a swing trader. This is because if you are using longer chart time frames to trade & you determine the price will be moving up it does not make sense to set a very tight stop loss because if the XAUUSD Gold price swings a little your stop loss will be hit.

The method of setting stop losses that you select will mainly depend on what type of XAUUSD trader you are. Most frequent used method to determine where to set stop losses is - resistance and support levels. These levels give good points for setting these stoploss order orders as they are the most reliable, because the support & resistance areas will not be hit many times.

The method for establishing these stop levels you select should adhere to the aforementioned guidelines, even if not all are applicable to your XAUUSD strategy.

Access Extra Tutorials and Lessons

- How to Set the On Balance Volume Indicator on MetaTrader 5 XAU/USD Charts

- Can you Download MetaTrader 5 in Mac?

- Beginner's Guide: Learning to Trade XAU/USD

- Initial Procedures for Starting Gold Trading Operations on the MetaTrader 4 Platform

- XAU USD Platforms & XAUUSD Broker Accounts

- How to Set MACD Indicator on XAU/USD Chart in MetaTrader 4 Platform Software

- How Do You Draw MT4 Channel Trading Indicator?